The cost of sales is an inventory accounting metric that measures the accumulated costs in getting finished goods to market. It represents your true cost of creating and selling a product.

This article will help you understand the cost of sales formula, how it can help you calculate profitability, and the steps you must take to reduce the cost of sales in your business.

What is cost of sales?

Cost of sales is the accrued total of all the costs of supplying a product. It only relates to those products you have sold. The cost of sales metric is most commonly used in the retail and eCommerce industries, whereas manufacturing businesses typically calculate profitability using the cost of goods sold formula instead.

Cost of sales and profitability

Cost of sales is a key indicator of profitability. It measures the cost of raw materials, labour, and overhead costs associated with producing finished goods. A high cost of sales doesn’t always imply lower profit margins. But if your costs of sales are disproportionate to your revenue, you should consider ways to manage your costs and improve profitability.

Cost of sales vs cost of goods sold

The difference between the cost of sales and the cost of goods sold (COGS) is in how your changes in inventories are managed. Both accounting approaches achieve the same result because your income and expenses will differ by equal amounts.

COGS measures the cost of producing a product from raw materials and parts. The cost of sales is the total cost of producing goods and services. However, those service providers who do not offer goods for sale will not include the cost of sales on their income statements.

Cost of sales vs operating expenses

Cost of sales and operating expenses are both important measures in assessing the profitability of a business. However, there are key differences in what they measure.

Cost of sales directly relates to a product or service. On the other hand, operating expenses support the whole business.

Costs that contribute to the production of a product or service – for example, raw materials, packaging, and the wages of employees directly involved in the delivery of goods – can be measured using the cost of sales. In contrast, operating expenses measure how much you spend on overhead costs such as rent, insurance, utilities, and office supplies.

While your cost of sales breaks down more readily identifiable expenses, your operating expenses look at general overall costs that are harder to classify.

Cost of sales formula

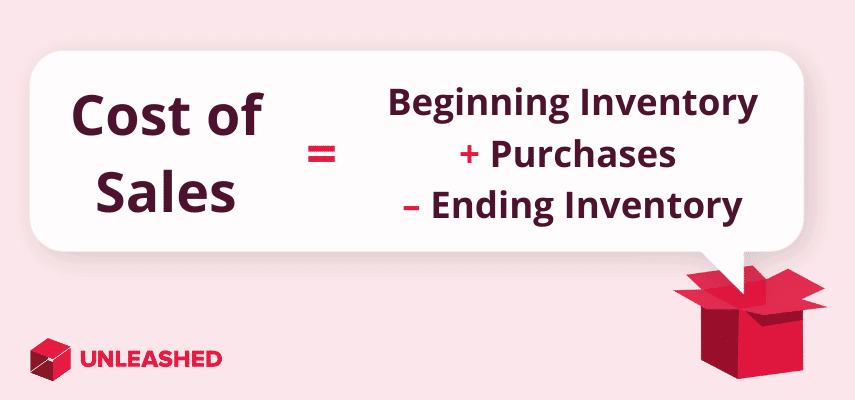

The cost of sales formula combines all the raw materials, labour, and direct purchases necessary to produce goods for sale. It includes employee wages and any shipping costs of the finished product.

Use this formula to calculate the total cost of sales in your business:

Beginning Inventory + Purchases – Ending Inventory = Cost of Sales

As an example, let’s say you have $35,000 in on-hand inventory at the beginning of your financial quarter. Throughout that quarter you spend $15,000 on raw materials, wages, and delivery costs.

With $7,000 worth of inventory left at the end of the period, you calculate the cost of sales for the period using the cost of sales formula:

$35,000 + $15,000 – $7,000 = $43,000

Total Cost of Sales = $43,000

How to calculate cost of sales

The main challenge with calculating the cost of sales is understanding which of your outgoings relate to your cost of sales. A simple way to determine what to include in the cost of sales is to look at the expenses you are currently paying.

For example, you could still manufacture your products if you stopped paying for marketing activities. Marketing expenses, therefore, should not be included in your cost of sales formula.

But if you stopped paying for, say, a plastic button that’s needed to produce a finished good, then you would be unable to get the product to market. That means this expense should be included in your cost of sales calculation.

Cost of sales combines all the costs associated with selling goods, from production through to retail.

Cost of sales combines all the costs associated with selling goods, from production through to retail.

What’s included in cost of sales?

What is and what is not included in your cost of sales calculation will largely depend on your business, the industry you’re in, and the types of products you are producing. If any cost is not directly or indirectly part of your production, it should not be included in your cost of sales.

Expenses that are often included in cost of sales:

- Raw materials required for production

- Salaries and wages for production staff

- Software licensing, website hosting fees, and cloud storage costs that are not part of your operating expenses

- Product packaging and packing material

- Storage costs incurred for storing both raw materials and finished goods

Expenses that are typically not included in cost of sales:

- Operating or fixed costs like rent and utilities

- Product development costs

- Commissions for your sales team

- Specific overhead costs not directly tied to production

- Administration costs

- Advertising and promotion

In retail, the cost of sales will also include any payments made to manufacturers and suppliers for the purchase of merchandise that you have sold.

Cost of sales examples

Cost of sales and COGS are used in different ways depending on the industry a business serves. Let’s look at some cost of sales examples across common sectors.

Manufacturing

A manufacturer will determine cost of sales or COGS by calculating all the manufacturing costs that go into producing goods. This can mean adding up production staff wages, raw material costs, and any purchases made that directly impact the manufacturing of products.

Once a manufacturer knows their cost of sales, they can investigate how much the market is willing to pay for their products and set a strategically competitive price that maximises profitability and sales.

Small business

If a small business purchases goods from a wholesaler, adds a personal touch to them, and resells the product then you could calculate the cost of sales by combining those purchase costs with the costs to prepare the goods for sale. For example, a small business's cost of sales calculation could include the purchasing cost of inventory and shipping from its suppliers along with the costs to customise and repackage the received goods.

Ecommerce and retail

In a retail or eCommerce business, inventory is typically purchased from a wholesaler or manufacturer for resale, either in a retail outlet or through an online store. The cost of sales will include the purchase price, any storage costs, and the cost of shipping goods to the customer.

Cost of sales accounting

Cost of sales accounting calculates the accumulated total of all costs you use to create a product that is sold. The cost of sales is a key performance indicator of your business. It measures your ability to design, source, or manufacture goods at a reasonable price – and can be compared with revenue to determine profitability.

If you’re using the periodic inventory method to calculate your cost of sales, then the costs of goods purchased are typically debited to your purchase account and credited to your accounts payable account.

Your balance of purchases account, at the end of the reporting period, is moved to your inventory account. This is shown as a debit to your inventory and credited to your purchases account. The result is a book balance in your inventory account that equals your actual ending inventory amount.

This variance is then written off as your cost of goods sales. It is debited to your cost of goods sold account and credited to your inventory account.

If you’re using the perpetual inventory method to calculate your cost of sales, then the cost of sales or COGS account increases as the product gets sold. In other words, the cost of sales is recorded with every sale in separate journal entries, rather than at the end of the period in a single entry.

Is cost of sales an expense?

Yes, your cost of sales is an expense. It is neither what your business owns (an asset), nor a liability that you owe. Cost of sales is directly related to the amount of money your business spends to acquire or produce a product you sell.

Cost of sales is one of the most important business expenses to consider when calculating profitability.

Cost of sales is one of the most important business expenses to consider when calculating profitability.

How to minimise your cost of sales

The purpose of reducing your cost of sales is to increase overall profitability within the business. The less it costs to produce goods, the better your profit margins.

There are several ways to minimise the cost of sales, including:

- Automate your manual processes

- Reduce wasteful activities

- Remove unnecessary product features

- Negotiate with suppliers for better pricing

- Optimise your inventory management

- Improve your warehouse logistics

- Invest in the growth of your employees

Let’s break these down.

1. Automate manual processes

Automation helps to lower the cost of sales while increasing your sales and productivity and supports business growth. Around 30% of sales tasks are automatable using current technology.

Some of those tasks include:

- Order management

- Lead identification

- Sales and operations planning

- Analytics and reporting

Review your entire sales chain to identify areas that will benefit from automation.

Implement chatbots to help generate leads, increase your sales, and free up your sales team's time. Chatbot technology offers substantial benefits to both your business and your customers.

Analytic tools can be utilised to increase customer acquisition and engagement, create a more personalised customer experience, and reduce customer churn.

2. Reduce waste

Look for opportunities to reduce physical waste and inefficiencies in your production processes. This includes raw material waste, shrinkage, and damaged or stolen goods.

If your material waste is high, look at ways to redesign your manufacturing process to reduce this waste.

Operational lost time or shipping process delays can also adversely affect your cost of sales.

Scrutinize all areas of your supply chain to identify instances of waste. Implement lean manufacturing methods to reduce or eliminate waste where possible.

3. Remove unnecessary product features

In some cases, it may be possible to reduce the cost of sales by changing the ingredients, components, or materials used to produce your products.

It’s important when removing product features as a cost-cutting measure that you are not removing product qualities that your customers value.

Research your customers’ reasons for purchasing your products. What are the features and benefits they look for? Is it low cost, unique features, or high quality?

When you establish which product features are important to your customers, you can selectively scale back those elements they see little value in.

4. Leverage suppliers

Negotiate with your suppliers to source better prices or discounts on bulk purchases.

In leveraging suppliers, you can take advantage of economies of scale that offer cost savings proportionate to increased production or sales. Take care to ensure any savings on bulk purchases are not lost to increased storage charges or the additional carrying costs associated with holding large amounts of inventory.

You can also work with suppliers to streamline purchase order cycle times to improve inventory lead times. This enables you to order less and frequently reduce inventory costs.

5. Optimise inventory management

Inventory ties up working capital, reduces cash flow and costs money the longer you keep it in storage. In some cases, goods can perish or become obsolete before they’re able to be sold.

It’s important to carefully manage your inventory to lower your cost of sales and increase profitability. Inventory management software and an optimised warehouse can help you efficiently manage and lower the cost of inventory.

In addition to these benefits, inventory software helps you make smarter purchasing decisions based on historical data and demand forecasts.

6. Improve warehouse operations

Organised warehouses and workspaces aid productivity because staff are not wasting time searching for tools and equipment.

Create an organised floor plan that is easy to navigate and supports operational flow and processes. Expand the footprint of your warehouse by making use of vertical space.

Ensure staff can access it easily and safely with the right equipment for efficient storage and picking. Standardise bins and keep selves neat and orderly. Label everything.

Production, employee, and storage expenses all represent aspects of your cost of sales; an efficient warehouse can reduce the cost of sales by improving productivity.

7. Invest in your employees

Employee labour costs represent a significant portion of the cost of sales. While the automation of manual tasks can minimise some of these labour costs, investing in employee development and upskilling their technical skills will save you money in the long term.

Disengaged, unhappy, and undervalued employees result in high staff turnover. High employee turnover will cost your business lost time, operational problems, reduced productivity, and the expense of recruiting and inducting new staff.

Training and development of your staff resources can drive value through greater productivity, performance, and increased customer service. Invest in your staff to reduce your costs and achieve higher profits.

Accurately track your cost of sales in real time with Unleashed

Keeping track of all the direct and indirect costs that go into selling a product manually is a time-consuming process.

Worse, it's prone to producing errors that can hurt your productivity and cut into your bottom line.

Unleashed provides automated inventory management software that automatically tracks and records all your purchasing, sales, and production costs as they occur. It allows you to manage your inventory on the cloud while removing inefficiencies from your key workflows.

Learn more about how Unleashed helps you accurately track cost of sales

1. Watch an inventory software demo. Learn how automated inventory software enables you to track all your crucial product costs in real time, slashing hours of admin time and ensuring accurate financial reporting.

2. Sign up for a free 14-day trial. Discover first-hand the ways Unleashed can help you streamlining reporting processes and optimise your inventory management with a risk-free two-week trial of Unleashed.

3. Chat with an expert to assess your needs. Are you ready to take your business to the next step? Lock in a free chat with one of our friendly in-house experts for an honest discussion about improving your operations and cost tracking.