Cost of production is the manufacturing metric that tells you exactly how much money was spent on producing a product or offering a service. If you don’t know your cost of production, there’s a serious risk of running the business at a loss.

Learn the different types of production costs, why they matter, and how to reduce your production costs in this guide.

What is cost of production?

Cost of production is the total expenses incurred by a business or manufacturer to produce goods or services. It includes all direct, indirect, fixed, and variable costs involved in the production of finished goods – for example, raw materials, labour costs, and daily consumables like screws and staples.

Tracking the cost of production is essential for understanding the profitability of your business.

By knowing the exact cost of production, you can make informed decisions regarding pricing, resource allocation, and operational workflows to improve your margins and manufacturing efficiency.

Cost of production vs cost of manufacturing

Cost of production and cost of manufacturing are sometimes used interchangeably. But there is a slight difference: Production costs include all the expenses required to conduct business, whereas manufacturing costs only cover what is required to make the product itself.

Cost of production formula

To determine the cost of production for your business or a single product, you can use this simple cost of production formula:

Fixed Costs + Variable Costs = Cost of Production

To calculate the total cost of production, sum up all fixed costs and variable costs incurred during the period you wish to measure (such as a month, quarter, or year). This total provides an overview of the financial outlay required to produce goods within the defined period.

Example of the cost of production formula

Here’s an example of how the cost of production might look for a business.

Variable costs:

- Overhead costs – $500

- Administrative costs – $200

- Insurance premiums – $100

Fixed costs:

- Raw materials – $300

- Labour costs – $400

- Packaging materials – $60

In this example, the total variable costs are $800, and the total fixed costs are $760.

The cost of production formula for the business would therefore look like this:

$800 + $760 = Cost of Production

Cost of Production = $1,560.00

9 common types of production costs

Here’s a quick summary of the various types of production costs and how they’re defined in a manufacturing setting.

1. Variable costs

Variable costs are expenses that fluctuate in direct proportion to changes in the level of production or sales. These costs increase or decrease based on the volume of goods produced or services rendered.

Examples of variable costs:

- Raw materials and components used in production

- Direct labour wages (for workers directly involved in production)

- Utilities consumed in production (e.g., electricity, water)

- Packaging materials

Variable costs directly impact the profitability of each unit produced or sold.

As production levels increase, variable costs also rise, and vice versa. Managing variable costs effectively is crucial for maximising profitability and ensuring the business can adjust expenses in response to changes in demand or market conditions.

2. Fixed costs

Fixed costs are expenses that do not vary with the level of production or sales within a certain range. These costs remain relatively stable over time, regardless of whether the business is producing many units or none at all.

Examples of fixed costs:

- Rent for office or manufacturing space

- Salaries of permanent staff (not directly tied to production levels)

- Property taxes

- Administrative expenses

Fixed costs represent the baseline operating expenses that a business must incur to maintain its operations, regardless of the level of production or sales. They provide a measure of the minimum expenses that need to be covered to keep the business running.

3. Direct costs

Direct costs are expenses that can be specifically traced to a product, service, or cost centre within a manufacturing organisation. These costs are directly attributable to the production of goods or services and typically vary with the level of production or sales.

Examples of direct costs:

- Raw materials and components used in manufacturing

- Direct labour wages for workers directly involved in production

- Production supplies directly consumed in manufacturing

- Cost of goods purchased for resale

Direct costs provide a clear and direct link to the production of goods or services.

By accurately tracking direct costs, you can determine the true cost of producing each unit and make informed decisions regarding pricing, profitability analysis, and cost control measures.

4. Indirect costs

Indirect costs, also known as overhead costs, are expenses that are not directly attributable to a specific product, service, or cost centre. These costs support the overall operation of the business and are incurred for the benefit of multiple activities or departments.

Examples of indirect costs:

- Rent for office space or manufacturing facilities

- Utilities such as electricity, water, and heating

- Insurance premiums

- Taxes and licences

Indirect costs are important because they contribute to the overall cost structure of the business and impact profitability indirectly. While not directly tied to production activities, indirect costs are essential for maintaining the operational infrastructure and supporting various functions within the organisation.

5. Product costs

Product costs are expenses directly associated with producing goods or acquiring inventory that will be sold to customers.

These costs are capitalised and reported on the balance sheet as inventory until the goods are sold, at which point they are expensed as Cost of Goods Sold (COGS) on the income statement.

6. Period costs

Period costs, also known as operating expenses, are expenses incurred during a specific period not directly tied to the production of goods or services. These costs are expensed on the income statement in the period in which they are incurred and are not included in the valuation of inventory.

7. Total production costs

Total production costs refer to the aggregate expenses incurred by a business during the process of manufacturing goods or providing services. These costs include all expenditures associated with converting raw materials into finished products, including direct and indirect costs.

Analysing total production costs helps you identify areas where costs can be controlled and optimised. It allows management to evaluate the efficiency of production processes, identify cost-saving opportunities, and implement strategies to improve profitability.

Essential for accurate financial reporting, total production costs are reported on financial statements such as the income statement, where they contribute to Cost of Goods Sold and gross profit.

8. Average cost

Average costs are the mean per-unit cost of producing goods or services, calculated by dividing total costs by the number of units produced or sold.

There are two main types of average costs:

- Average Total Cost (ATC): This is the total production cost per unit of output. It includes all costs incurred in producing goods or services, such as direct materials, direct labour, overhead expenses, and administrative costs.

- Average Variable Cost (AVC): This represents the variable cost incurred per unit of output. Variable costs are expenses that fluctuate with production levels, such as raw materials, direct labour wages, and utilities directly related to production.

9. Marginal cost

Marginal cost is the cost incurred by producing an additional unit. It specifically measures the change in total cost when production output increases by one unit. Marginal cost is calculated by dividing the change in total cost by the change in quantity produced.

What costs are included in cost of production?

The cost of production is the total of all costs incurred to produce a product or offer a service. This covers everything from the screws used to fasten one component to another to the maintenance fees required for repairing machinery.

This table breaks down the most common types of production costs:

|

Type of Cost |

Definition |

Examples |

|---|---|---|

|

Direct materials costs |

Any raw materials and components directly used in the manufacturing process. |

|

|

The expenses associated with holding and storing inventory. |

|

|

|

Direct labour costs |

The cost of employing and maintaining staff directly involved in the production process. |

|

|

Indirect costs incurred during the production process that cannot be directly attributed to specific units of output. |

|

|

|

Administrative costs |

Overhead expenses related to the general management and administration of the business. |

|

|

Research & Development (R&D) costs |

Expenses associated with developing new products and improving existing ones. |

|

|

Quality control costs |

Costs related to ensuring that products meet quality standards and specifications. |

|

|

Logistics costs |

Expenses related to storing, packaging, and transporting finished goods to customers. |

|

How to reduce your production costs

According to a Supply Chain Survey by Blue Yonder, around 48% of businesses have seen profit margins shrink due to rising costs. The survey revealed that raw materials are the most affected area, followed by inventory, transportation, and labour.

Reducing production costs involves analysing and controlling the different types of costs to optimise efficiency, pricing strategies, and overall financial performance.

Here are six effective strategies to achieve cost reduction in manufacturing:

1. Factory layout optimisation

Optimising the layout of the production facility can streamline workflows, minimise material handling, and reduce production cycle times.

Here are three ways you can optimise factory layout:

- Arrange equipment and workstations in a logical sequence to minimise movement and transportation time.

- Maximise the use of available space to reduce unnecessary storage and movement.

- Intentionally design work areas to enhance worker efficiency and safety, reducing fatigue and injury risks.

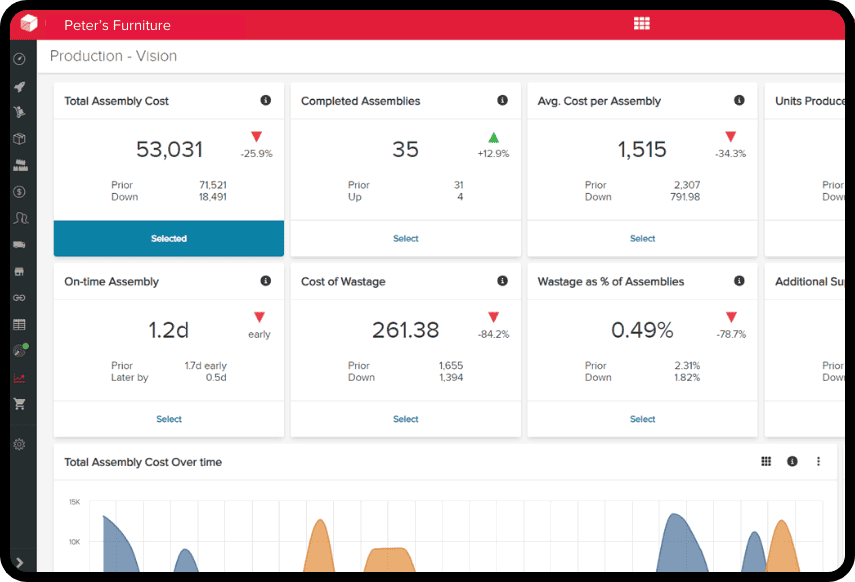

2. Manufacturing inventory management software

Manufacturing inventory management software is an automated system that can improve inventory visibility, accuracy, and control to reduce production costs and increase productivity.

The software centralises production planning, sales, and inventory data to establish a connected platform for managing all your most important processes. Manufacturing inventory software also helps track the exact costs that go into making a product, reducing the manual labour and risk of human error involved in accounting for manufacturing.

Useful features of manufacturing software include:

- Demand forecasting: Use historical data and trends to predict demand, optimising inventory levels and reducing excess stock.

- Manufacturing inventory management: Align inventory levels with production needs to minimise holding costs while ensuring materials are available when needed.

- Supplier management: Integrate with suppliers to streamline procurement processes and track supplier performance.

- Bill of materials management: Track the status of each production job, including which raw materials and components are required for an assembly and whether they’re available.

- Batch and serial number tracking: Gain total inventory traceability over your various parts and products by assigning batch and serial numbers to each item.

Are you interested in discovering whether manufacturing inventory software is right for you?

Try Unleashed for free today with our risk-free, 14-day trial, or book a call with one of our manufacturing experts for an honest assessment of your manufacturing needs.

3. Lean manufacturing

Lean manufacturing is a production management strategy that focuses on eliminating waste and improving efficiency across production processes.

It reduces the total cost of production by establishing smarter ways of working, reducing downtime, and ensuring cost-effective inventory management for manufacturing stock. Lean manufacturing also allows for more flexibility in the production process, enabling you to respond quickly to unexpected shifts in supply or demand.

There are various methods and tools for implementing lean manufacturing into your business, and it’s worth investigating which ones can most benefit your existing workflows.

4. Energy efficiency initiatives

Implement energy-saving measures to reduce utility costs and environmental impact.

Perform energy audits, wherein the energy consumption of your production processes is assessed to identify areas for efficiency improvements.

Investing in energy-efficient machinery and lighting systems can help bring your cost of production down. Promoting energy-saving practices among employees – such as turning off equipment when not in use – can also reduce your utility costs.

5. Supplier relationships and negotiations

Strengthen relationships with suppliers to secure favourable pricing, terms, and delivery schedules.

One way you can do this is through supplier consolidation. This means consolidating purchases with fewer suppliers to leverage volume discounts and establish better relationships with your vendors. Try to negotiate long-term contracts to increase pricing stability and predictability.

6. Quality control and waste reduction

Improving product quality and reducing waste through effective quality control measures can help lower the production costs associated with manufacturing new products.

Some methods for achieving this include:

- Statistical Process Control (SPC): Monitor production processes in real time to detect and address quality issues.

- Root cause analysis: Identify underlying causes of defects and implement corrective actions to prevent recurrence.

- Zero defects: Strive for zero defects through rigorous quality assurance practices and employee training.