Accurate inventory accounting requires accurate data. Opening inventory, correctly calculated, is an essential figure for determining the costs and profitability of your business. It can be used to calculate the cost of goods sold and other useful inventory reports.

Read on to discover everything you need to know about opening inventory, including the formula and how to calculate it.

What is opening inventory?

Opening inventory, also known as beginning inventory, is the total value of stock held by a business and able to be sold at the start of an accounting period. When calculated correctly, opening inventory should equal the ending inventory from the previous accounting period.

In manufacturing, opening inventory can include raw materials, assemblies, and finished goods. In retail and distribution, it most commonly refers to products that are available to be purchased by consumers.

There are several reasons why it’s important to know your opening inventory value.

The first is that this data can be compared with previous accounting periods to identify sales trends which can inform more accurate forecasting and smarter purchasing. This information can also feed into key decisions around how you manage your supply chain, where to increase or decrease business investment, and how to manage your labour force.

Another is that it’s a useful figure for calculating other financial metrics, such as cost of goods sold (COGS) and gross profit. Accuracy in these calculations is crucial for understanding which products and processes are making you the most money – and how much they’re making.

Opening inventory formula

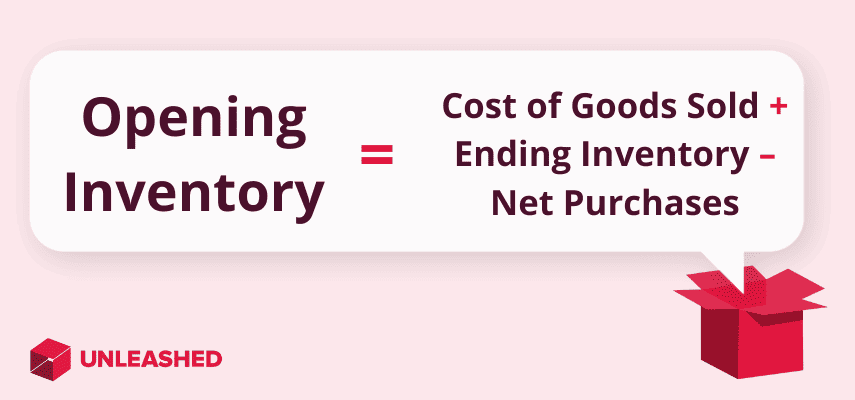

To work out your opening inventory, you will first need to calculate your COGS and have a record of your total purchases and ending inventory from the previous period. Once those are ready, you can determine the figure using the opening inventory formula.

The opening inventory formula is:

COGS + Ending Inventory Value – Purchases = Opening inventory

To make it easy for you, here’s how you can get the inputs you need for the formula above.

How to calculate opening inventory

First, determine your cost of goods sold for the previous period. Cost of goods sold shows the total production and purchasing costs that are required to create and sell a product. It includes all elements of the production including materials, parts, and labour. It does not include indirect expenses such as marketing, or taxes.

Together with ending inventory – which can be determined by subtracting COGS from the sum of your previous period’s opening inventory and net purchases – you will be halfway towards knowing your opening inventory value.

Then simply subtract the total inventory purchase costs for the previous period to calculate your final opening inventory figure.

Here’s a summary of how to calculate opening inventory in four steps:

- Calculate your COGS for the previous accounting period.

- Calculate your ending inventory for the previous accounting period.

- Add COGS and ending inventory together.

- Tally up your net purchases for the period and subtract them from the previous figure.

Opening inventory valuation methods

Several methods can be used for valuing opening inventory. It’s important to choose the right accounting method for your business and to ensure it is consistent across all periods.

When deciding what accounting system to use, research your sector and national regulations. You will likely also need to draw on advice from a chartered accountant as there may be laws and accounting standards you will need to adhere to.

The three most common methods for calculating opening inventory are:

- FIFO

- LIFO

- Weighted average

Let’s quickly recap how these work.

The FIFO method

The first-in, first-out (FIFO) method is where the products purchased or produced the least recently are the first to be sold to the customer. Goods are sold in an order determined by the date they were built or purchased from a supplier.

The LIFO method

The last-in, first-out (LIFO) method is the opposite of the FIFO method. Using LIFO, the most recent purchases are sold first. This allows businesses to mitigate any increasing costs of holding inventory. Notably, LIFO is only allowed under the US generally accepted accounting principles (GAAP). Companies that report under the International Financial Reporting Standards must use FIFO or the weighted average method

The weighted average method

The weighted average method calculates the average cost of a company’s inventory based on individual costs and divides them by the number available. The benefits of this method are that it’s far simpler to track and cuts back on paperwork and administration. We recommend this method for most businesses as it can save time and money when tracking inventory costs.

How to find beginning inventory with cloud software

Although the formula above can be useful for manual calculations, it requires a lot of input and tedious data analysis. You’ll need to have accurately tracked all your sales and expenses and attributed them correctly using specific inventory costing methods.

Done manually, this can take a long time – and be prone to errors.

The good news is that it’s possible to automatically determine beginning inventory using cloud software designed for this very purpose.

Cloud-based inventory management software tracks the value and movement of all your inventory throughout the year, automatically assigning costs and adjusting stock levels whenever goods are sold.

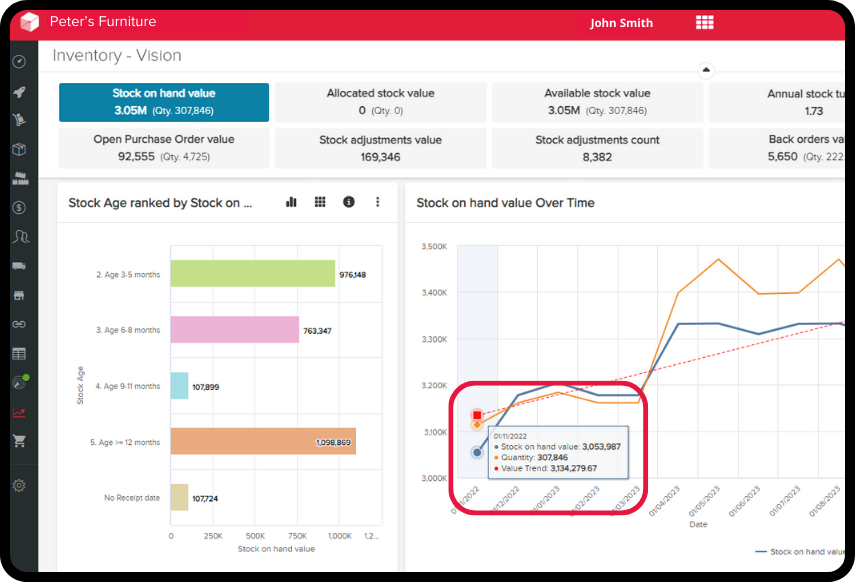

If you’ve already set up a cloud software system like Unleashed, simply run an inventory report from your dashboard to find the beginning inventory value for the specified period.

Learn more: Watch our inventory software demos on how Unleashed can help you generate inventory reports.

Alternatively, head over to the Unleashed BI Vision dashboard and select “Stock on hand value”. This will pull up reports demonstrating your inventory value over a select timeframe, including the value of your opening inventory at the start of the period.

The relationship between opening inventory and closing inventory

Understanding the relationship between opening and closing inventory is key to delivering accurate inventory accounting and making decisions that result in maximised profit for your company.

The main way in which opening inventory and closing inventory are related is that the closing inventory for one period should be equal to the opening inventory for the following period.

These two inventory data points are also linked on a strategy level. They deliver the information required for you to assess ongoing expenditure, purchasing decisions, warehouse strategy, and labour management.

Here are some ways opening and closing inventory can help your business:

- Opening inventory: Opening inventory reflects the value of your goods at the start of the period. It serves as a base figure for determining how much you’ve made, how much you’ve spent, and where you’ve spent it.

- Closing inventory: Closing inventory provides a clear window into the costs and financial benefits of selling a product at a certain price point. Highlighting the sales and costs in a complete period can reveal where improvements should be made and where efficiencies can be gained.

Finally, both metrics figure into other key inventory formulas that enable better tracking of your general inventory management processes.

Why it’s important to know your opening inventory

Understanding your opening inventory is not just smart – it’s an essential part of running a business that deals with products.

Opening inventory is important to know because it helps you:

- File financial reports: Accurate reporting of the opening inventory figures will ensure your financial statements show the true financial health of your business, including the gross profit.

- Comply with tax and payment obligations: As a responsible party, you are required to accurately report the financial health of your business and comply with tax obligations, including payments or any penalties that may accrue. This includes an accurate recording of your opening inventory for each period.

- Report to investors, shareholders, and lenders: Your investors and shareholders will also have a keen interest in the company’s financial health. There may be trigger levels at which concerns are raised. Accurate opening inventory can assuage concerns about financial risk for investors.

- Fully understand costs and profits: Opening inventory is essential for knowing the total costs and profits of your business, which feed into key decisions around purchasing and sales strategies.

- Make smart strategic decisions: If your opening and closing inventory values reveal that the cost of certain items is too high, you can pull back on that product line. Conversely, if there is a large demand for a product you may want to focus more on that market niche.

Opening inventory: When to use it and why

The opening inventory financial metric is necessary when assessing the value of goods, materials, or costs at the start of an accounting period. But it also has other uses worthy of your consideration.

Here are some ways opening inventory can be useful in running your business:

- Doing your financial reports: Opening inventory is a starting point from which you can determine the various inventory valuation figures you need to report on. It can also aid in checking in on the general financial health of your organisation at any given time.

- Understanding the cost of goods: The opening inventory feeds into COGS, which tells you how much you’re spending on creating and selling goods – and where your margins are.

- Gross profit analysis: The opening inventory figure is also a good indicator for the ultimate gross profit analysis (although the final analysis will likely include other variables).

- Budgeting and financial planning: The opening inventory figure gives a window into what has happened during a specific period, which improves your ability to plan, budget, and strategize for the period ahead.

More posts like this: