Inventory carrying cost is an essential figure to understand. Without it, you’ll struggle to accurately measure profitability or make informed decisions around inventory management and cash flow.

With a simple calculation, you can understand what it costs to store and maintain goods. This number can then be used as a benchmark for continual improvement, supporting sustainable business growth.

This article breaks down everything you need to know about inventory carrying cost, with examples and formulas for calculating it in your business.

What is inventory carrying cost?

Inventory carrying cost is the total sum of any expenses associated with holding inventory within a warehouse or storage facility until it is sold or used in production. This includes any overhead costs – such as rent or utilities – as well as intangible expenses like inventory shrinkage, opportunity cost, and insurance fees.

Why is inventory carrying cost important?

Inventory carrying cost is important because it directly impacts a business's financial performance, including profitability and cash flow. Effective management of carrying costs is essential for optimising inventory levels and overall business success.

The main benefits of measuring inventory carrying costs include:

- Financial management: Inventory carrying costs directly impact your financial health and profitability. High carrying costs can eat into profits, while efficient management can lead to cost savings and improved cash flow.

- Inventory levels: Maintaining too much inventory ties up capital and increases carrying costs, while too little inventory can lead to stockouts and lost sales. By considering carrying costs, you can determine the optimal level of inventory to hold.

- Risk management: Holding excess inventory increases the risk of obsolescence, damage, theft, or spoilage. By understanding carrying costs, businesses can make informed decisions about inventory levels to mitigate these risks.

- Customer service and satisfaction: 37% of consumers who encounter a stockout will choose to shop with another business, and nearly 10% will buy nothing at all. Carrying the right amount of inventory ensures that products are available when customers need them.

- Competitive advantage: Effective inventory management, driven by an understanding of your carrying costs, can provide a competitive advantage by reducing costs, improving cash flow, and enhancing customer service.

Inventory turnover and inventory carrying costs

Inventory turnover (which measures how quickly inventory is sold and replaced within a specific period) is closely related to inventory carrying costs. Higher inventory turnover rates generally result in lower carrying costs as inventory is held for shorter periods, reducing your storage and holding expenses.

What are the types of inventory carrying costs?

Inventory carrying costs can be categorised into several types, each representing different expenses associated with holding and managing inventory within a business.

Below are the seven main types of inventory carrying costs.

1. Storage costs

Storage costs are the direct costs you have to pay to keep unused inventory on your premises.

They include expenses related to the physical storage of inventory, such as:

- Warehouse rent or mortgage payments

- Utilities (electricity, water, heating)

- Property taxes

- Facility maintenance

Because they often make up a large chunk of a company’s total inventory carrying cost, reducing your storage costs can have a positive impact on your profitability.

2. Handling costs

Handling costs encompass the expenses associated with managing and moving inventory within the warehouse or distribution centre.

This includes:

- Labour costs for warehouse personnel

- Equipment maintenance and depreciation (e.g., forklifts, pallet jacks)

- Packaging materials

- Transportation within the facility

By implementing lean strategies into your processes, you can reduce your holding costs and improve operational efficiency in one fell swoop.

3. Capital costs

Capital costs represent the opportunity cost of the funds tied up in inventory.

This includes the cost of capital used to purchase inventory, which could have been invested elsewhere for potential returns. Additionally, they may involve the interest expense on loans or lines of credit used to finance inventory purchases.

4. Opportunity costs

Opportunity costs refer to any potential income that could have been earned if the funds invested in inventory had been used elsewhere, such as in investments or interest-bearing accounts.

While this can be difficult to quantify, it’s important to include it in your inventory carrying cost calculations. Knowing your opportunity costs won’t just help improve the accuracy of your carrying cost; it will also help guide future decisions around budget and cash flow.

5. Obsolescence and shrinkage costs

In the US, shrinkage accounts for 1.62% of a retailer’s bottom line. These costs arise from inventory becoming obsolete, damaged, or lost due to factors like spoilage, theft, or deterioration.

It’s vital to account for any potential losses due to expired products, changes in consumer demand, or technological advancements rendering certain inventory items obsolete.

6. Insurance costs

Inventory insurance premiums protect against losses due to theft, fire, natural disasters, or other unforeseen events that could damage or destroy inventory. The cost of insurance varies depending on the type and value of inventory, as well as the level of coverage desired.

Your insurance costs at the individual inventory item level should never be overlooked, as they may significantly hinder your ability to maximise revenue and profit.

7. Taxes

Inventory may be subject to various taxes depending on local regulations and accounting standards. This could include property taxes on inventory held within a warehouse or distribution centre, as well as inventory taxes levied by certain jurisdictions.

What inventory costs are not considered carrying costs?

Not all costs associated with inventory qualify as inventory carrying costs.

To ensure accuracy in your carrying cost calculations, exclude the following:

- Cost of Goods Sold (COGS): The cost of goods sold represents the direct costs associated with producing or purchasing the goods that are sold to customers. While closely related to inventory, COGS is not considered an inventory carrying cost as it reflects the direct expenses incurred to acquire or produce inventory items.

- Ordering costs: Also known as setup costs or procurement costs, ordering costs are the expenses incurred by a business each time it places an order for inventory or materials from suppliers. These costs are associated with the process of initiating and managing orders and include various activities and expenses related to purchasing goods.

- Production costs: Costs directly related to manufacturing or producing inventory items, such as raw materials, labour, and manufacturing overhead, are not considered inventory carrying costs. These costs are part of the production process and are typically accounted for separately from inventory carrying costs.

- Shortage costs: Also known as stockout costs or stock shortage costs, shortage costs are the expenses and negative consequences that occur when a business runs out of inventory or fails to meet customer demand due to insufficient stock levels.

- Costs of sales and marketing: Expenses related to sales and marketing efforts – such as advertising, sales commissions, and marketing campaigns – are not considered inventory carrying costs because they are not directly tied to the holding and storage of inventory.

- Administrative overhead: General administrative expenses – such as salaries for administrative staff, office supplies, and utilities for office spaces – are not classified as inventory carrying costs. These costs are associated with running the overall operations of the business and are not specific to inventory management.

How to calculate inventory carrying cost

To calculate inventory carrying costs, you need to identify and quantify the various expenses associated with holding and managing inventory within your business.

Begin by categorising the different types of expenses related to inventory carrying costs.

Collect data on each cost category. This may involve reviewing invoices, payroll records, utility bills, insurance premiums, and tax statements related to inventory management.

Sum up the expenses incurred within each cost category over a specific period, such as a month, quarter, or year. Then decide on the time frame for calculating inventory carrying costs. Typically, businesses assess these costs annually.

Next, determine the average value of inventory held during the chosen period. This can be calculated by adding the beginning inventory value to the ending inventory value and dividing by two.

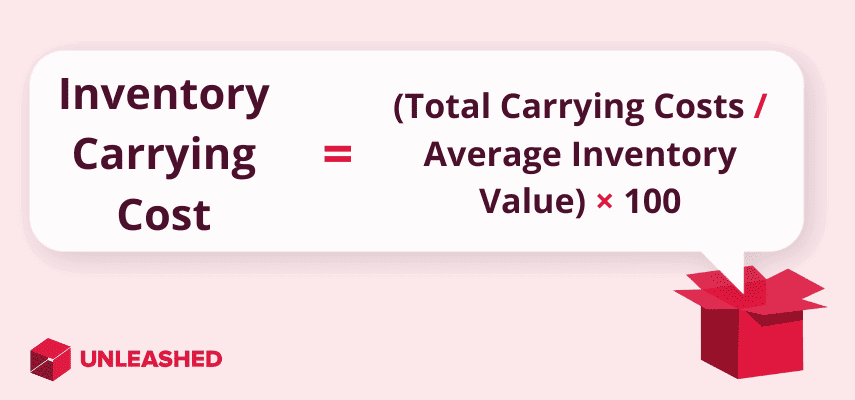

Inventory carrying cost formula

Once you know your average inventory, you can use the inventory carrying cost formula to determine carrying cost as a percentage. Divide the total inventory carrying costs by the average inventory value and multiply by 100.

The inventory carrying cost formula is:

(Total Inventory Carrying Costs / Average Inventory Value) × 100

Once you've calculated the inventory carrying cost as a percentage, analyse the findings to understand the financial impact of holding inventory.

Consider whether the costs are within acceptable limits and identify areas where cost-saving measures can be implemented. Regularly review and reassess your inventory carrying costs to identify opportunities for improvement.

Implement strategies to optimise inventory management practices and minimise carrying costs while maintaining adequate inventory levels to meet customer demand.

Inventory carrying cost example

Let's consider a simplified example of inventory carrying costs for a retail business that sells electronic gadgets. The company rents warehouse space to store its inventory of electronic items.

The monthly rent for the warehouse is $2,000.

Warehouse personnel are responsible for receiving, organising, and picking inventory. The monthly labour cost for these employees is $3,500.

The company financed its inventory purchases using a line of credit with an annual interest rate of 8%. The average inventory value over the year is $300,000.

Due to technological advancements, some inventory items may become obsolete or damaged. The company estimates obsolescence and shrinkage costs to be $500 per month.

The company also pays an annual insurance premium of $4,800 to insure its inventory against theft, fire, and other risks.

Finally, the company incurs property taxes on its inventory storage facility, amounting to $1,200 per year.

To calculate the total inventory carrying costs for the year, we add up the costs from each category:

|

Type |

Value |

Total Cost |

|---|---|---|

|

Storage costs |

$2,000/month × 12 months |

$24,000 |

|

Handling costs |

$3,500/month × 12 months |

$42,000 |

|

Capital costs |

$100,000 (average inventory value) × 8% |

$8,000 |

|

Obsolescence and shrinkage costs |

$500/month × 12 months |

$6,000 |

|

Insurance costs |

$4,800 (annual premium) |

$4,800 |

|

Taxes |

$1,200 (annual property taxes) |

$1,200 |

|

Inventory carrying cost |

$86,000 |

So the formula is:

($86,000 / $300,000) × 100 = 28

This means that the carrying costs of the inventory are 28% of the total cost of inventory for this business, which is within the expected average of between 20% and 30%.

How to reduce your inventory carrying costs

Reducing inventory carrying costs is essential for businesses to improve efficiency, maximise profitability, and maintain a competitive edge in the marketplace.

In the US, retailers, on average, hold $1.35 worth of inventory for every dollar of sales. Every extra cent that is tied up in inventory means it isn’t available for investing in growth or other areas of the business.

Here are some strategies to reduce inventory carrying costs.

Inventory optimisation

Analyse historical sales data, demand forecasts, and lead times using inventory optimisation software to determine the ideal stock levels for each product. Avoid overstocking by aligning inventory levels with actual demand to minimise excess inventory holding costs.

Just-in-time (JIT) inventory management

Adopt JIT inventory management practices to minimise excess inventory holding costs and reduce the need for warehouse space. JIT helps streamline operations by ordering inventory only when needed, thereby reducing carrying costs associated with excess inventory.

Accurate demand forecasting

Enhance demand forecasting accuracy by leveraging advanced analytics, historical data analysis, market trends, and customer insights.

Accurate forecasting enables businesses to procure the right amount of inventory at the right time, minimising the risk of overstocking and associated carrying costs.

Supplier negotiation

Collaborate closely with suppliers to negotiate favourable pricing, discounts, and payment terms. Establish long-term relationships with reliable suppliers to secure competitive pricing, reduce procurement lead times, and minimise inventory carrying costs.

Inventory management software

Invest in inventory management systems and technologies to track inventory levels, monitor sales trends, and automate replenishment processes. Utilise barcode scanning, RFID technology, and inventory tracking software to improve inventory visibility, accuracy, and control.

See how it works in this short explainer video:

Reduce your inventory carrying costs and slash admin time – sign up for a free 14-day trial of Unleashed today.

Warehouse optimisation

Streamline warehouse layout and operations to minimise handling and storage costs. Implement efficient storage systems – such as ABC classification and slotting optimisation – to prioritise high-demand items and reduce picking and replenishment times.

Inventory audit

Regularly monitor inventory levels and identify slow-moving or obsolete items. Offer discounts, promotions, or liquidation sales to reduce excess inventory and minimise obsolescence costs.

Apply solid inventory control measures, security systems, and employee training programs to prevent theft, damage, and shrinkage.

Transportation and distribution costs

Evaluate transportation and distribution costs associated with inventory management. Explore cost-effective transportation options, optimise delivery routes, and consolidate shipments to minimise transportation expenses and improve supply chain efficiency.