The cost of goods manufactured (COGM) metric is essential for maintaining profitability and efficiency in a manufacturing business. It represents the total expense incurred during the production process within a specific period and enables you to assess the true cost of bringing products to market. COGM will ultimately influence your pricing strategies and decision-making processes.

This article dives into the intricacies of COGM, including the formula for calculating it and the implications for manufacturing accounting and financial performance.

What is the cost of goods manufactured?

The cost of goods manufactured (COGM) is the total cost to produce finished goods during a specific period incurred by a company. It includes all direct and indirect costs associated with the manufacturing process, including raw materials, labour, factory overheads, and other production-related expenses.

Cost of goods manufactured vs cost of goods sold

The difference between the cost of goods manufactured and the cost of goods sold (COGS) lies in their timing and purpose in the production and sales process.

COGM represents the total cost incurred by a company to produce finished goods during a specific period. It reflects the expenses accumulated during the manufacturing process, regardless of whether the goods are sold or not.

Conversely, COGS refers to the total cost of any goods that were sold to customers during a specific period. It includes the direct costs associated with producing the goods, as well as any additional costs directly attributable to the production process.

COGS is calculated by subtracting the ending inventory from the cost of goods available for sale. It represents the expenses directly related to the goods sold during the period.

In summary, COGM reflects the total cost of manufacturing goods – whether they were sold or not – while COGS represents the cost of only those goods that were sold to customers during a specific period.

Cost of goods manufactured schedule

The COGM schedule is a part of the financial statement of a business that shows the total cost incurred by a company to manufacture goods during a specific period, typically a month or a year. COGM is used in the income statement of the reporting and is subtracted from sales to then calculate gross margin (the portion of a company’s revenue after direct costs have been removed).

Cost of goods manufactured formula

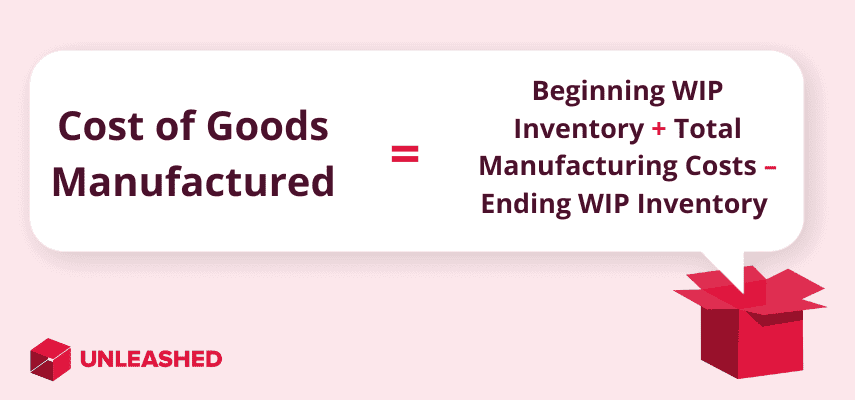

COGM is calculated by adding the beginning work in process inventory to the total manufacturing costs incurred during the period and subtracting the ending work in process inventory. This calculation helps you to understand the total expenses involved in converting raw materials into finished goods and is essential for determining the cost of goods sold and profitability.

Formally, the COGM formula can be expressed as:

Beginning Work in Process Inventory + Total Manufacturing Costs – Ending Work in Process Inventory = Cost of Goods Manufactured

Why the cost of goods manufactured formula is important

The cost of goods manufactured formula provides a clear picture of the total expenses incurred in the manufacturing process within a specific period, making it a vital metric for companies involved in the manufacturing supply chain.

The benefits of measuring COGM include:

- Understanding production costs: The COGM formula breaks down all the costs involved in producing goods, including raw materials, labour, and overhead expenses. This breakdown helps businesses understand the components contributing to their production costs.

- Budgeting and planning: By knowing the total cost of manufacturing, businesses can better plan and budget for future production cycles. It helps in setting realistic production targets and estimating future expenses accurately.

- Inventory management: COGM helps in managing inventory levels efficiently. Comparing COGM with COGS helps in assessing whether the production output matches the sales demand. It also aids in identifying any discrepancies between actual production and sales, which can inform adjustments in inventory levels.

- Cost control and optimisation: Analysing COGM over time allows businesses to identify areas where costs can be reduced or optimised. It helps in making informed decisions regarding resource allocation, process improvements, and cost-saving measures.

- Financial reporting: COGM is a crucial component in financial statements, such as the income statement and balance sheet. It helps in calculating the cost of goods sold and determining the gross profit margin – two vital metrics for assessing a company's financial performance.

The COGM formula provides valuable insights into a company's manufacturing operations, guiding decision-making processes, and facilitating accurate financial management and reporting.

How to calculate the cost of goods manufactured

To calculate the cost of goods manufactured (COGM), first add up all the costs incurred during the manufacturing process within a specific period.

These costs include:

- Raw materials cost: Add up the cost of all raw materials purchased during the period. This includes materials directly used in the production of goods.

- Direct labour cost: Calculate the total wages and benefits paid to workers directly involved in the manufacturing process. This includes wages for workers directly involved in assembling or manufacturing the products.

- Factory overhead costs: Include all other manufacturing costs not directly attributable to raw materials or direct labour. This can include expenses such as utilities, depreciation of machinery, factory rent, maintenance, and other indirect manufacturing costs.

- Beginning Work in Process inventory: If there is any unfinished inventory from the previous period, include its value as it represents the work already started but not completed.

- Ending Work in Process inventory: This accounts for the work started but not yet completed during the current period.

If we dissect the COGM formula above, it begins to look something like this:

Raw Materials + Direct Labour + Factory Overheads + Beginning Work in Process Inventory − Ending Work in Process Inventory = Cost of Goods Manufactured

By following this calculation, you can determine the total cost incurred to manufacture goods during a specified period and gain valuable insights into your production expenses.

Cost of goods manufactured example

For a clearer idea of how the COGM formula works, let’s look at a hypothetical example.

A company that manufactures mountain bikes needs to know how profitable its manufacturing process is to determine optimal pricing and marketing budgets.

For the month of April, they incur various costs for the manufacturing process:

- Raw Materials: They purchase tyres, screws, seats, handlebars, and other necessary ingredients required to assemble their bikes. The total cost of these materials comes to $20,000.

- Direct labour: The company relies on employees to assemble the bikes. The total wages paid to these workers for the period amounts to $10,000.

- Factory overheads: These additional costs include utilities, depreciation of machinery and rent – totalling $4,000.

- Beginning WIP inventory: At the beginning of April, there were partially completed bikes from the previous month's production. The total value of these unfinished assemblies is $3,000.

- Ending WIP inventory: At the end of April, the ending work in process inventory is also $3,000.

To calculate the cost of goods manufactured for April, they use the COGM formula:

$20,000 + $10,000 + $4,000 + $3,000 − $3,000 = $34,000

The cost of goods manufactured for the company during April is $34,000. This represents the total cost incurred by the company to produce the mountain bikes during that month.

Cost of goods manufactured journal entry

The COGM journal entry records the costs incurred by a company during the manufacturing process. This entry is crucial for accurately reflecting the manufacturing expenses in the company's accounting records.

The first part of the entry involves debiting various manufacturing accounts to reflect the costs incurred (this includes accounts such as raw materials inventory, WIP inventory and manufacturing overheads).

Then, as raw materials are consumed during the production process, their value in the raw materials inventory account decreases. Therefore, the journal entry credits raw materials inventory to reduce its balance.

If any accrued manufacturing costs haven't been paid yet but have been incurred during the period, they are credited in this entry. The same applies to WIP inventory, which represents the value of partially completed goods. The journal entry credits WIP inventory to reflect the portion of manufacturing costs that have been added to the work in process.

Manufacturing overhead includes indirect manufacturing costs such as utilities, depreciation, and maintenance, so the journal entry will credit manufacturing overheads to account for these costs incurred during the manufacturing process.

In the end, the COGM journal entry accurately reflects the flow of manufacturing costs through the company's accounts, ensuring that the financial statements provide a clear picture of the expenses associated with producing goods.

To calculate cost of goods manufactured, you first need to determine all your production costs and WIP inventory.

To calculate cost of goods manufactured, you first need to determine all your production costs and WIP inventory.

Calculating the cost of goods manufactured with cloud manufacturing software

Cloud manufacturing software streamlines and automates the process of calculating the cost of goods manufactured by integrating with various systems– such as inventory management, procurement, production planning, and accounting systems – to allow for real-time access to accurate data related to production activities.

Because it can automatically capture data directly from the production floor through sensors, barcode scanners, or manual input from workers (and can allocate costs to specific production orders or batches based on actual usage and activity), cloud manufacturing software also assigns raw material costs, labour costs, and overhead expenses to each unit of production, ensuring accurate cost tracking for individual products.

Sophisticated algorithms can allocate indirect manufacturing costs (overheads) to production orders. This means it can use cost drivers such as machine hours, employees’ hours, or square footage to assign overhead costs more accurately.

Once all relevant data is captured and allocated, the software automatically calculates the total cost of goods manufactured for each production order or batch by applying the COGM formula.

Why cloud software is essential for accurate COGM

A key benefit of using cloud manufacturing software for COGM is that it generates comprehensive reports and dashboards which provide insights into production costs, efficiency, and profitability. Managers can then analyse COGM data to identify cost-saving opportunities, optimise production processes, and make informed decisions about resource allocation and pricing strategies.

Unleashed manufacturing inventory software simplifies and accelerates the calculation of COGM by automating data capture, leading to more accurate and timely insights into manufacturing costs.

If you’d like to find out whether Unleashed is the right solution for you, here are some next steps:

1. Watch a cloud manufacturing software demo. Learn how Unleashed helps you track all your production costs to provide an accurate picture of your COGM, profitability, and cash flow that’s consistently updated in real time.

2. Sign up for a free 14-day trial. See first-hand how to boost manufacturing efficiency and reduce your cost of goods manufactured with a risk-free two-week trial of Unleashed.

3. Chat with an expert to assess your needs. Are you ready to take your business to the next step? Book a free chat with one of our in-house manufacturing experts to determine the solution that’s best for you.