Days Sales of Inventory (DSI) is a key measure to help you understand how efficient your inventory management is.

Here we explain what DSI is, how to use it, and why it's crucial to track this metric in your business – whether you’re a retailer, manufacturer, wholesaler or distributor.

What is Days Sales of Inventory (DSI)?

Days Sales of Inventory is a calculation to work out the average period of time (in days) that it takes for a business to sell its products or inventory. It’s also known as Days Sales in Inventory and Average Age of Inventory.

As such DSI is a crucial measure of how your inventory management is performing – and DSI is also used to calculate your Cash Conversion Cycle.

Typically, the lower the average number of days, the better it is for the business. That’s because less stock on hand means less overheads and that sales are strong. However, there are a number of variables to this, which we’ll discuss in this article.

For retailers, DSI is a straightforward way to keep track of how quickly stock moves through the business. It’s important to note that it does differ from Inventory Turnover – which we’ll also explain below.

For manufacturers, it’s about understanding how long the process takes from receiving inventory to manufacturing a product and achieving a sale. By focusing on DSI, manufacturers can look to streamline or improve their production capabilities, in order to bring the average Days Sales of Inventory down.

What is the formula for Days Sales of Inventory?

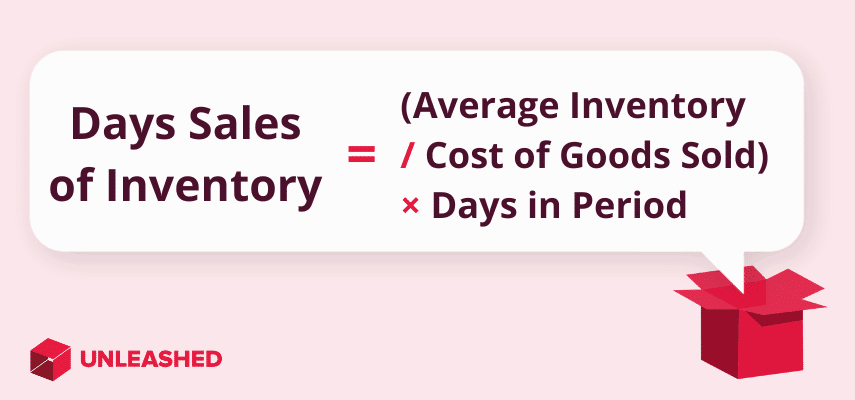

The formula for Days Sales of Inventory is:

- Days Sales of Inventory = (Average Inventory ÷ COGS), multiplied by 365

So to calculate the Days Sales of Inventory, you need two other figures: Average Inventory and Cost of Goods Sold (COGS). Here we take you through how to calculate each of these, then move on to how you calculate Days Sales of Inventory.

How do you calculate Average Inventory?

The first figure you need is Average Inventory you have in stock for the period. This is an estimation of the amount or value and is done by adding the beginning inventory to the ending inventory, divided by two:

- Average Inventory = (Beginning Inventory Value + Final Inventory Value), divided by 2

How do you calculate Cost of Goods Sold (COGS)?

The next figure you need to calculate is COGS, which is a metric that relates to the direct costs of a product that a business sells. This includes the cost of the materials to manufacture the item – or for a retailer, it will be the cost of purchase from a wholesaler.

COGS doesn’t include things such as distribution, sales, marketing and overheads. It’s also worth noting that the value of COGS – which is also known as cost of sales – can vary depending on the accounting standards used in the calculation.

The calculation for COGS is:

- COGS = (Beginning Inventory Value + Purchases Made), minus Final Inventory Value

How do you calculate Days Sales of Inventory?

Finally, once you have your Average Inventory and COGS, you can now calculate the Days Sales of Inventory. You do this by taking your Average Inventory and dividing this by COGS, then multiplying the result by a time period:

- Days Sales of Inventory = (Average Inventory ÷ COGS), multiplied by 365

The time period is usually 365 days, but you can use 90 days if you’re concentrating on the DSI per quarter.

With your DSI, you have a benchmark for your own business and a figure you can use as a comparison to others in your industry.

- Learn more: Five Effective Ways to Reduce Cost of Goods Sold

To calculate Days Sales of Inventory, use the three-step process outlined above: first get your Average Inventory, then your COGS, and then you’re ready to use the DSI equation

To calculate Days Sales of Inventory, use the three-step process outlined above: first get your Average Inventory, then your COGS, and then you’re ready to use the DSI equation

Examples of Days Sales of Inventory

So what does Days Sales of Inventory look like in practice? Here we give you a couple of examples.

1. An Example of DSI: Stevie’s TVs

Stevie’s TVs is going to calculate its Days Sales of Inventory for the last financial year. The Average Inventory for this period had a value of $50,000 and the Cost of Goods Sold (COGS) was $150,000. So the calculation for DSI is:

- 50,000/150,000 x 365 = 121.7

So 121.7 days is how long it took, on average, for Stevie's TVs to turn stock into sales.

2. Fresh Supermarket's DSI

As another example, Fresh Supermarket is going to work out its DSI for the past 12 months. The Average Inventory value for this period was $20,000 and the Cost of Goods Sold (COGS) was $150,000, so the calculation for DSI is:

- 20,000/150,000 x 365 = 48.7

With perishable goods – and lower-cost items – it’s easy to understand why Fresh Supermarket would have a far lower DSI than Stevie’s TVs.

Is Days Sales of Inventory the same as Days Inventory Outstanding?

DSI is the same equation as Days Inventory Outstanding (DIO) - they’re just called different things.

Just to confuse things further, this calculation is also sometimes referred to as:

- Average Inventory Days

- Inventory Days on Hand (DOH)

- Days in Inventory (DII)

The names are different, but the principle is the same – it's a way to work out the number of days it takes for stock to turn into sales.

And whatever name you call it, you’ll use the same equation – Average Inventory ÷ COGS x 365 days.

Higher-value goods such as TVs will generally have a much higher DSI value than lower-value fast-moving goods, such as groceries

Higher-value goods such as TVs will generally have a much higher DSI value than lower-value fast-moving goods, such as groceries

What two different versions of the Days Sales of Inventory formula are used?

When doing the DSI calculation, there are two different calculations you can use depending on the accounting practices of your business and how you prefer to calculate Average Inventory. These are:

1. With Average Inventory for a specific period of time:

This is the method we’ve used above. For this method, you use a start date and end date for your Average Inventory to calculate the DSI value during that specific time period. So the calculation you use for Average Inventory is:

- Average Inventory = Starting Inventory + Ending Inventory / divided by 2

2. With Average Inventory calculated ‘as of’ a specific date:

Alternatively, you can use the Average Inventory figure as reported at the end of an accounting period, for example the end of the financial year. This means that when you calculate the DSI, the value will be ‘as of’ a particular date.

- Average Inventory = Ending Inventory (e.g. at the end of the financial year)

Note that COGS remains the same for both calculations.

What’s the difference between Days Sales of Inventory and Inventory Turnover?

DSI is often confused with Inventory Turnover – but there are a few key differences.

These both tell you about the time it takes to shift inventory, but they do it in different ways:

- Days Sales of Inventory tells you the average number of days it takes to turn stock into sales.

- Inventory Turnover gives you a ratio that tells you how many times you completely replace your stock in a given period – usually a year.

The formula for Inventory Turnover is:

- Inventory Turnover = COGS / Average Inventory

This means that businesses are looking for a lower DSI number, and a higher Inventory Turnover ratio – since both of these indicate that stock is moving quickly through the business.

Inventory Turnover is an important metric for businesses to cover, as it provides a clear indication of how well it is moving through its inventory and achieving sales – but DSI is able to provide deeper insights into inventory management and the efficiency of the stock-to-sale timeline.

Inventory Turnover is another calculation you can use to understand how quickly your stock is shifting – but for this metric, you’ll be aiming for a higher ratio

Inventory Turnover is another calculation you can use to understand how quickly your stock is shifting – but for this metric, you’ll be aiming for a higher ratio

What does the Days Sales of Inventory ratio tell you?

Now that we are through all those calculations and numbers, let’s talk about the relevance of DSI for a business. What does it show and how do you actually interpret these figures?

If we rewind a bit, DSI is actually the first part of the cash conversion cycle (CCC), which is a calculation to measure the average length of time that the net input dollar is held in the stock of the business, before it is converted to cash received from sales.

Days sales outstanding (DSO) and days payable outstanding (DPO) are the other two parts of CCC, which measure how long it takes to receive accounts receivable payments. and how long it takes to make payment on its accounts payable.

So while you can look at DSI in isolation, it can also be helpful to combine it with those other two measurements. But on its own, DSI allows you to have greater visibility over the inventory in your business, to see whether you have too much on hand, or aren’t carrying enough – which means you’re having to continually reorder.

With a DSI number, you’re able to not only benchmark your businesses performance against others, but also see where you could implement strategies in your organisation to help increase your liquidity, instead of having it tied up in inventory. Stock isn’t just a cost in itself, but also requires rent, insurance, storage and other related expenses.

What do low and high Days Sales of Inventory levels mean?

Earlier in this article, we mentioned that having a low DSI is preferable for most, because it means that stock is moving quickly through the business – sales are good and inventory is being held at the right level. And yes, it's certainly the ideal situation as the less time you have stock sitting in your business, the less chance you have of stock becoming obsolete.

However, there are some instances where a high DSI may be desirable for a number of reasons. This could be when an organisation is wishing to stockpile products for an upcoming peak season, or to meet predicted customer demand. Rapid fulfilment is crucial in some industries, and this may require an organisation to ensure it always has enough stock on hand.

More commonly, though, the more days you have inventory, the more likely you will lose money on it, negatively impacting your overall ROI, as well as prospective investors and creditors.

- For DSI, generally the lower number the better; for Inventory Turnover, generally the higher the better.

Having a lower DSI is better for most businesses, but pinning down what your DSI rate should be depends on a variety of factors – including but not limited to the industry you’re in

Having a lower DSI is better for most businesses, but pinning down what your DSI rate should be depends on a variety of factors – including but not limited to the industry you’re in

What is a good Days Sales of Inventory figure for businesses?

As mentioned above, there are many variables that affect what a good DSI looks like, as it depends on the industry you're in, the characteristics of the goods you're selling, and your business model.

For example, a supermarket will have a low DSI for most products because they are perishable – hence the name FMCG, fast moving consumer goods. But a car sales yard will likely have quite a high DSI by comparison.

It can be a little difficult to find out the DSI of various industries, as it’s not really something businesses go around shouting from the rooftops. But some examples of benchmarks for DSIs are:

- Furniture Stores – 107

- Office Supplies – 44

- Appliance Retailers – 78

- Pharmacies – 26

Why is DSI important for businesses – and their investors?

There’s a number of reasons it’s helpful to know your DSI figure, and here are a few key examples:

- You can make informed decisions about your inventory management, and whether it is working as well as it could be. Could you hold less stock or would running it lean put you at the risk of supply chain issues?

- If your DSI is quite high, what are some of the ways you could reduce it? Maybe you could look at your pricing and offer discounts to get stock moving.

- You will have a benchmark to track your business performance against for future reporting.

- You can see where cash flow may be tied up – if there is a lot of value sitting in your inventory, it could be hurting your business in other areas.

- There is less risk of products going out of date or becoming unsaleable. Of course this is crucial in FMCG, but is also relevant to stock that needs to be sold by a certain deadline – for example seasonal products like those for Christmas and Easter, or anything that will lose value the longer it sits ‘on the shelves’.

- DSI also helps with inventory forecasting. If you regularly calculate your DSI, you will be able to understand where fluctuations may occur and how to plan for that when it comes to managing your inventory.

For investors, DSI allows them to gain greater insight into the performance of a business. It helps them understand liquidity, efficiencies and the profitability of the organisation when viewing financial statements – the information they are typically given when looking into whether a business is suitable for investment.

Inventory management software takes care of recording your data so it’s accurate and on hand when you wish to calculate DSI – and it also provides you with Business Intelligence tools to track KPIs and other important metrics

Inventory management software takes care of recording your data so it’s accurate and on hand when you wish to calculate DSI – and it also provides you with Business Intelligence tools to track KPIs and other important metrics

What are some problems with using the Days Sales of Inventory metric?

As with anything, there are some caveats to bear in mind when looking at your DSI – especially if you’re a large business with varied stock. These include:

- The fact that the DSI figure is an average and doesn’t take into account individual products – you may have some that move faster than others.

- While implementing strategies to lower the DSI can help with movement of stock, it could affect profits and your bottom line.

- There’s also the risk of turning stock into sales faster than you’re able to acquire new stock, leading to a shortage in supplies.

To address these potential issues, ensure you consider your DSI alongside the other elements of inventory management and your overall business strategy.

And when comparing yourself to others in the industry, there’s always the potential for dishonesty. A business could easily report a low DSI, but not declare it was because a large amount of stock was discounted – resulting in quick sales – or even written off.

What tools can you use to calculate Days Sales of Inventory?

To calculate your DSI, you’ll need to have clear and accurate records of the value of your inventory, costs and sales for the period in question.

Inventory software can give you this information without the hassle of finding and updating spreadsheets – and you’ll know your data is accurate and up to date. With a range of inventory reports available and the ability to filter your data across fields like date range, you’ll have all you need at your fingertips, ready to go.

Another quick and easy way to track your business’ performance against targets you’ve set is using Business Intelligence. This uses your inventory data to generate reports on KPIs like sales revenue and profit margin – and you can even automate the process so updates on targets are sent straight to your inbox.

How to check average inventory days in Unleashed

- Learn more: The Business Intelligence tool for Unleashed