Days Inventory Outstanding (DIO) is a fundamental inventory metric for measuring efficiency and liquidity inside a product business. It’s used frequently in inventory accounting to help businesses understand their holding costs and make optimised purchasing decisions.

In this article, we explore what Days Inventory Outstanding is, how to calculate it, and how to improve the result.

What is Days Inventory Outstanding?

Days Inventory Outstanding (DIO) is a liquidity metric which measures the average number of days inventory is held in a business before it is sold.

The DIO ratio can be used to estimate sales performance over time and to determine whether you’re overstocking certain items. This helps you understand where some of your costs are coming from so you can make better decisions around purchasing and inventory management.

- Other names: Days Inventory Outstanding is also known as Days Sales of Inventory (DSI), the inventory period, the average age of inventory, and Days in Inventory (DII).

Days Inventory Outstanding formula

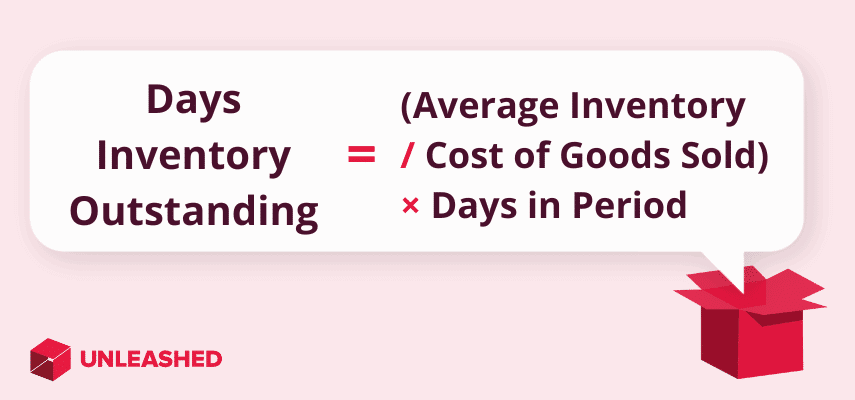

The Days Inventory Outstanding formula is:

(Average Inventory / Cost of Goods Sold) × Days in Accounting Period = Days Inventory Outstanding

You can use the DIO formula to measure the performance of your inventory management. A lower number typically means your business is carrying less stock on hand, and therefore spending less on overheads and running more efficiently.

This formula also contributes to the equation needed to determine your cash conversion cycle.

How to calculate Days Inventory Outstanding

To calculate your DIO, you’ll need to know:

- The accounting period you intend to measure (365 days is the standard)

- The total cost of your inventory at the beginning of that period

- The total cost of your inventory at the end of that period

- Average inventory (the sum of your beginning and ending inventory, divided by two)

- Your total cost of goods sold (COGS)

Once you’ve got these, you can calculate DIO using the formula:

(Average Inventory / COGS) × Days in Accounting Period = DIO

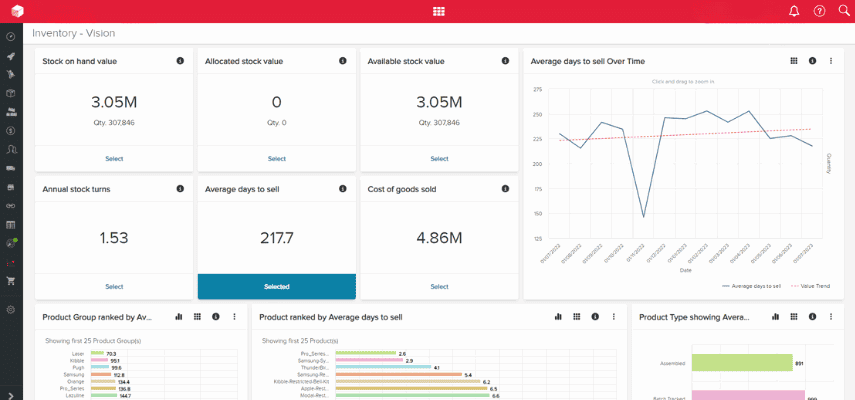

Inventory management software like Unleashed can automatically calculate DIO for a business and create reports for comparing average DIO between different products, accounting periods, and more.

Inventory management software like Unleashed can automatically calculate DIO for a business and create reports for comparing average DIO between different products, accounting periods, and more.

Days Inventory Outstanding example

To help you understand how Days Inventory Outstanding works, let’s use the example of John’s Pharmacy.

John’s Pharmacy wants to calculate its DIO for the last financial year. The beginning inventory value was $100,000 and the ending inventory value was $200,000. This means the average inventory value for John’s Pharmacy is $150,000.

The total cost of goods sold for that year was $1,000,000. In other words, it cost John’s Pharmacy $1 million to produce and prepare for sale the goods that it sold that year (excluding additional costs).

Here’s how that looks using the Days Inventory Outstanding formula:

(150,000 / 1,000,000) × 365 = 54.75

This tells us that, on average, John’s Pharmacy held its inventory for 54.75 days before it was sold. Because pharmacies typically sell perishable goods, a DIO of 54.75 days could mean some goods expire before they’re able to be sold – not ideal for a business looking to efficiently manage its inventory.

While we’re on that subject, let’s quickly talk about what a good DIO result looks like in business.

What is a ‘good’ DIO number?

A good DIO number is one that’s low relative to a business’s industry: the faster you can get inventory out the door, the lower your storage costs.

But the broad answer is that there is no universal ‘good’ DIO.

For some industries, it’s important to maintain as low a DIO score as possible, while other industries can handle a higher figure and may even expect it – think about how long it can take luxury car dealers to shift all their stock. (Jump down to the How to use Days Inventory Outstanding in your business section of this article to see some benchmark DIO figures for popular retail industries.)

What a low DIO means

A low Days Inventory Outstanding rate means you’re selling inventory efficiently relative to how long it’s kept in storage. This means inventory is converted into cash more readily, so you have more money to spend on other activities. It also means you’re spending less on the overhead costs associated with holding stock.

What a high DIO means

A high Days Inventory Outstanding rate means it takes your business a long time to sell stock relative to how long it’s kept in storage. This could mean that your sales performance needs attention, or it could be a symptom of having purchased too much inventory. A high DIO indicates high inventory costs and a slower inventory turnover.

How to use Days Inventory Outstanding in your business

Tracking the Days Inventory Outstanding metric is a useful activity for understanding the liquidity of your business in each accounting period. The results can help you identify inventory bottlenecks and make informed decisions to increase workplace efficiency.

Here are some best practices for using DIO in your business.

1. Track DIO regularly

Calculating your DIO on a regular basis helps you monitor your sales and inventory management performance over time, providing a clearer picture of your financial health throughout the year.

If your DIO is trending upwards, you should analyse your sales process and demand forecasting strategy. Investing in inventory management software with demand planning features will help you set more accurate stock levels and reduce your holding costs.

If your DIO is trending downward, you’re doing something right. Try to identify what might be causing the improvements in your inventory management efficiency and double down on them.

Continue to look for ways to optimise your business and drive sales – just be careful if you start to sell goods faster than you can supply them, as this will lead to stockouts and dissatisfied customers.

2. Benchmark your business against industry peers

If you’re trying to work out what a ‘good’ DIO is for your business, compare it with similar organisations from the same sector.

Because DIO tracks the movement of inventory, some industries will naturally have higher or lower scores. A supermarket, for example, will always strive for a very low DIO score. Whereas a furniture store or car dealership can afford to hold on to its stock for longer.

Your goal should be to keep your DIO lower than your industry average.

The table below reflects the average DIO scores for different sectors of the retail industry for FY 2022 based on research conducted by Retail Dogma:

|

Sector |

Average Days Inventory Outstanding |

|---|---|

|

Clothing |

114 |

|

Furniture |

107 |

|

Supermarkets |

25 |

|

Pharmacies |

26 |

|

Cosmetics |

87 |

|

Office Supplies |

44 |

|

Household Appliances |

78 |

3. Use DIO in the correct context

When analysing your DIO, take into consideration the factors that may be affecting inventory sales.

For example, some businesses will sell stock at different speeds during seasonal changes, before and after specific holidays, and during a sale.

External factors such as supply chain disruptions and weather events can also impact your DIO.

You might over-purchase a raw material if you expect it to be in short supply soon. This can result in a higher-than-normal DIO that doesn’t reflect poor business performance. A sudden surge in demand can have the opposite effect, reducing your DIO despite no improvements being made to boost efficiency.

Days Inventory Outstanding vs inventory turnover

Days Inventory Outstanding is a calculation of how fast a business moves inventory. It measures the time spent holding onto stock, and the costs associated with that time. Inventory turnover, on the other hand, refers to the speed it takes to sell.

The main difference between DIO and inventory turnover is that inventory turnover measures how often inventory is sold while DIO measures the average time, in days, an inventory item is held in stock before being sold.

Inventory turnover is calculated using this formula:

COGS / Average Inventory = Inventory Turnover

Using the figures from our earlier pharmacy example, the inventory turnover for John’s Pharmacy would be 6.7. This means that the pharmacy replenished its stock just under seven times in one year.

The relationship between DIO and inventory turnover can therefore be summed up as:

When DIO is high, inventory turnover is low; when DIO is low, inventory turnover is high.

5 ways to improve Days Inventory Outstanding

Improving your Days Inventory Outstanding rate enables your business to reduce storage costs and improve overall inventory efficiency. Here are some strategies for achieving that.

1. Optimise your inventory management

Automating your workflows and tracking stock in real-time is essential for optimised inventory management. Both can be achieved with the implementation of cloud-based inventory software.

Modern inventory management software automatically collects data and builds reports around key inventory metrics – including DIO. In addition, cloud-based inventory management systems are capable of tracking stock movements as they happen. This means you’ll always know how much you have in store, where it’s being held, and how it’s costing your business.

You can also integrate inventory software with other cloud systems, such as accounting and CRM, and with warehousing equipment like barcode scanners. This massively improves the efficiency and accuracy of your inventory management processes.

2. Go lean

Going lean in business means trimming the fat from wasteful activities. A lean business can operate effectively and efficiently while holding very little stock, which minimises the total costs of your inventory.

Taking inspiration from lean organisations can help you better understand how to purchase new stock cost-effectively. Going lean can help prevent overstocking, therefore reducing DIO.

3. Look for ways to supercharge sales

Improving sales is the fastest way to ship the stock you already have more quickly, lowering your DIO.

But ‘improving sales’ is incredibly generic. To make this strategy actionable, let’s consider the indicators that should act as focal points when investigating the best ways to improve sales for your specific business.

The questions you need to ask before deciding how to improve sales:

- Is there a demand for my products?

- Are we visible in the market?

- Are customers satisfied with their orders?

- Are we able to fulfil orders on time every time?

- Does seasonality or other external factors affect how quickly products are sold?

- Are we utilising our storage space efficiently?

The answers to these questions may indicate that a new sales strategy is necessary. This could mean that the solution is better market research, marketing, and product development. Or the answers may indicate that the problem is not your sales strategy, but how and when you get goods to the customer.

4. Get paid quicker

There’s a good chance that slow or late payments from customers are creating cash flow lag. In other words, your income doesn’t balance out the costs of producing or storing inventory.

So, how do you get paid more quickly?

Here are a few fast tips:

- Send invoices faster. The quicker you get your invoices to the customer, the quicker they can turn them around. Invoicing software can help with this.

- Offer prompt-payment discounts. Incentivising faster payments can be an effective way to improve cash flow.

- Chase up late payments. Get comfortable chasing your invoices. Oftentimes people simply forget to pay, so don’t be shy about sending reminders or hiring a collection agent.

Learn more: 7 Ways to Improve Cash Flow in a Manufacturing Business

5. Drop your laggards

Analyse your sales data using inventory software reports to identify which products are causing the most issues. Compare product manufacturing and carrying costs with sales and inventory turnover. You may find that some products cost you a relative fortune to produce and store but don’t earn much in sales.

These are your laggards. Determine where they sit in the product life cycle and be prepared to cull specific SKUs from the product portfolio if necessary.

If they’re not important to your business, transferring the focus from these laggards to more high-demand, cost-effective products can greatly improve DIO and revenue over time.

Days Inventory Outstanding summary

DIO is a useful metric for establishing sales performance and inventory efficiency. If you’ve got good-quality data (you’re using an inventory system that pulls the correct inventory metrics), it’s fast and easy to find your Days Inventory Outstanding rate.

However, you can’t rely solely on the findings from your DIO to make decisions. Always consider what factors could affect the result. Utilising DIO to calculate your cash conversion cycle can build a more accurate picture of sales and inventory performance over time.