The cash conversion cycle (CCC) represents the journey of cash within a business. It’s a primary indicator of your business’s liquidity risk and operational efficiency.

By shortening your CCC, you minimise the risk of cash flow getting tied up in unsold inventory and accounts receivable.

What is the cash conversion cycle?

The cash conversion cycle, also known as the cash cycle, is a financial metric that measures the time it takes a business to convert inventory and other resources into cash flow. It begins with the purchasing of inventory and resources and ends with the collection of payment from customers.

There are three key components of the cash conversion cycle:

- Days Inventory Outstanding (DIO) – The time it takes for inventory to be sold. To find out your DIO, divide average inventory by the cost of goods sold (COGS) multiplied by the number of days in a period.

- Days Sales Outstanding (DSO) – The time it takes for sales to be converted into cash. To calculate your DSO, multiple the average accounts receivable by the number of days in period and then divide by sales.

- Days Payable Outstanding (DPO) – The average number of days it takes to pay your suppliers for purchases made on credit. To determine your DPO, multiply the number of days in a period by the average accounts payable and then divide by the cost of goods sold.

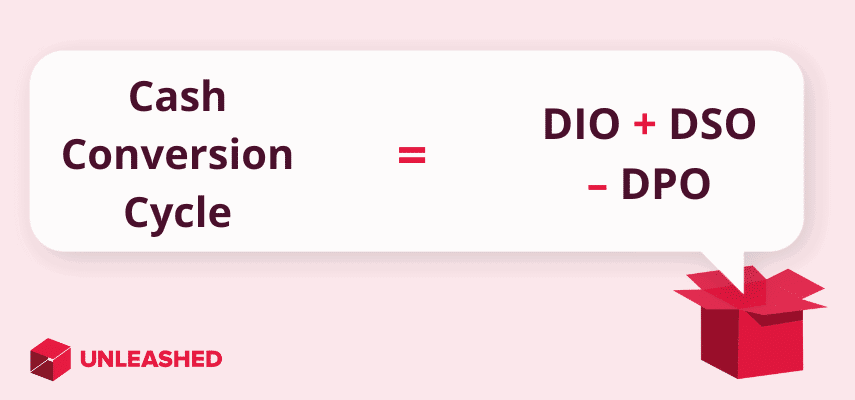

Cash conversion cycle formula

The cash conversion cycle can be calculated using the formula:

Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO) = Cash Conversion Cycle

So, if a company’s DIO is 80 days, its DSO is 43 days, and its DPO is 50 days, then the cash conversion cycle could be calculated as:

80 + 43 – 50 = 73 days

Why is the cash conversion cycle important?

The cash conversion cycle is important because it indicates the financial health of a business in each period. It can be used to infer the efficiency of your inventory planning and operational management.

When a business takes too long to convert inventory into cash, it becomes at risk of running out of capital. This can lead to unpaid bills, unfulfilled customer orders, and insolvency.

- A shorter cash conversion cycle means you’re able to convert your inventory and other resources into cash more quickly. This results in better liquidity and less reliance on business loans or financing. A short CCC also means greater flexibility to meet financial obligations and more available capital to invest in growth opportunities.

- A longer cash conversion cycle means your cash is tied up in inventory or accounts receivable for extended periods. This could cause cash flow constraints that limit your business’s flexibility to adapt to changes in the market. A long CCC may also restrict you from paying suppliers, negatively impacting established relationships.

By measuring your cash conversion cycle, you can minimise the risk of insolvency.

If you notice a trend of rising CCC values – that is, your CCC is getting longer each period – you should investigate and analyse your operations for inefficiencies.

The cash conversion cycle is a vital tool for all businesses that deal with inventory. Tracking it can help improve your company’s financial health and operational processes before they cause you problems.

The cash conversion cycle formula is helpful for determining the financial health of your business.

The cash conversion cycle formula is helpful for determining the financial health of your business.

How do you calculate the cash conversion cycle?

To calculate the cash conversion cycle, you’ll first need to know:

- Number of days in the period you intend to measure

- Revenue and COGS

- Beginning inventory for the period

- Closing inventory for the period

- Accounts receivable at the beginning and end of the period

- Accounts payable at the beginning and end of the period

Once you've got these, you need to calculate the three components of the CCC: days inventory outstanding (DIO), days sales outstanding (DSO), and days payable outstanding (DPO).

Finally, use the cash conversion cycle formula to get your CCC.

Step 1: Calculate Days Inventory Outstanding (DIO)

Start by determining the average inventory value during a specific period. As an example, let’s use a 12-month cycle period and imagine your average inventory is $50,000.

Next, calculate the cost of goods sold (COGS) per day. For our example, let’s imagine your COGS for the year is $365,000. So, the COGS per day would be $1,000.

Now divide the average inventory value by the COGS per day:

50,000 / 1,000 = 50

Your DIO is 50 days.

Step 2: Calculate Days Sales Outstanding (DSO)

The next step is to calculate the average accounts receivable value during the same period as your DIO.

Your average accounts receivable is $30,000 and your total net credit sales for the 12-month period is $730,000.

Now, divide the average accounts receivable by the sales per day. If the sales per day is $2,000 ($730,000 / 365 days), then the calculation is:

30,000 / 2,000 = 15

Your DSO is 15 days.

Step 3: Days Payable Outstanding (DPO)

Let's say your average accounts payable for the period is $20,000. Recall that the COGS per day was $1,000.

Now, divide the average accounts payable by the COGS per day:

20,000 / 1,000 = 20

Therefore, your DPO is 20 days.

Step 4: Calculate Cash Conversion Cycle (CCC)

Finally, to calculate your CCC you must subtract the DPO from the sum of your DIO and DSO.

In this case, that calculation would look like:

50 days + 15 days – 20 days = 45 days

This means that it takes approximately 45 days, on average, for your business to convert investments in inventory and other resources into cash flow from sales.

Regularly monitor your cash conversion cycle to stay on top of any production or retail bottlenecks.

Regularly monitor your cash conversion cycle to stay on top of any production or retail bottlenecks.

What is a negative cash conversion cycle?

A negative cash conversion cycle refers to a situation in which a business receives funds from sales before they’ve paid for the inventory that was sold. This occurs because suppliers often offer credit lines to retailers, allowing them to delay payment on received goods – usually for up to 30 days.

According to a study by Harvard Business School, Amazon utilised a negative cash conversion cycle during the infamous dot-com crash of 2000. They were then able to use that infusion of cash flows to grow their business despite market turbulence.

As they grew in influence and size, Amazon was able to compound the positive effects of its negative cash conversion cycle by pressing suppliers for better terms so they could delay payments even further.

How to use the cash conversion cycle to improve cash flow

The cash conversion cycle can be used as a tool for optimising cash flow and processes within a business. Your CCC will aid in identifying trends and bottlenecks creating the most significant impact on cash flow.

Analyse each component of the cash conversion cycle – DIO, DSO, and DPO – to pinpoint where the delays are occurring.

Common causes of a long CCC include:

- slow-moving inventory

- inefficient operational processes

- slow to collect payments

- poor inventory forecasts

- slow to pay bills

It’s important to mention that, while industry standards for optimal CCC values exist, the only target you should care about is the one that maximises efficiency for your specific company. If you can pay creditors on time and access the necessary cash flow for growth, you’ve got a healthy CCC.

5 ways to improve the cash conversion cycle

By improving your cash conversion cycle, you can free up more cash flow, increase liquidity, and improve the financial health of your business.

The strategies below will need to be tailored to your specific business, industry, and operational requirements. But by focusing on these areas and continuously monitoring your cash conversion cycle, you can boost your business’s cash flow management, and drive overall success.

Here are five ways to improve the cash conversion cycle:

1. Optimise inventory management

Inventory optimisation is a fundamental step in reducing the time it takes to convert inventory into cash, and therefore improve your CCC value.

Optimise your inventory management by implementing cloud-based inventory software, accurate demand forecasting, and best-practice stock control processes to minimise excess inventory and holding costs.

These strategies can help to inventory turnover and reduce stock levels, enabling faster receipt of cash from sales.

2. Accelerate accounts receivable collection

Prompt collection of receivables is beneficial for the cash conversion cycle, so fast-tracking the collection of accounts receivable is a desirable goal.

You can achieve this by:

- Putting clear invoicing procedures in place.

- Setting up timely reminders for payments.

- Offering convenient payment options to customers.

- Providing incentives for early payments .

Consider introducing credit policies to manage risk and establish stronger relationships with clients.

Regularly review your accounts receivable ageing and prioritise following up on overdue payments. By reducing your DSO, you can convert sales into cash faster.

A negative cash conversion cycle can be advantageous for growth-minded companies.

A negative cash conversion cycle can be advantageous for growth-minded companies.

3. Optimise accounts payable management

Close monitoring of accounts payable can positively impact the cash conversion cycle and improve cash flow. Where possible, negotiate favourable payment terms with suppliers. Always pay on time so that you can leverage your credibility for even better terms in the future.

You should also ensure accuracy in invoice processing and take advantage of any early payment discounts offered. By extending payment periods strategically and managing payables effectively, you can regulate overall cash flow – freeing up cash for other business needs while maintaining healthy vendor relationships.

4. Improve operational efficiency

Enhanced operational efficiency can lead to a shorter cash conversion cycle.

Focus on streamlining processes, reducing production and delivery times, and eliminating bottlenecks.

Here are some ways you can boost workplace efficiency:

- Automate repetitive manual tasks.

- Adopt modern technology solutions.

- Optimise resource allocation.

Learn more: How to Improve Receiving Efficiency

5. Monitor and improve forecast and cash flow projections

Accurate cash flow forecasting and proactive cash flow management are vital for optimising the cash conversion cycle.

By regularly reviewing your cash flow projections, you can position yourself to anticipate any changes, identify potential cash flow gaps or surpluses, and take appropriate actions to mitigate risk.

Forecasting cash flow more accurately means you can proactively manage your cash requirements and make more informed financial decisions, such as adjusting your operations, expenses, or investment plans.

Keep on top of any changes in customer demand, payment patterns, or supplier terms that could impact on your cash conversion cycle.