Landed cost is a crucial metric for understanding profitability at the product level. It takes into account sales and production costs, along with any additional fees required to ship a product to the end consumer.

Without it, you'll struggle to achieve an accurate measure of how well your business is doing.

This guide breaks down how landed cost is calculated, why it matters, and strategic ways to lower your landed costs and increase profitability. Let’s dive in.

What is landed cost?

Landed cost is the total cost of a product after it has been shipped to a customer. It includes any raw materials, freight, customs duties, insurance, warehousing, and related fees and overheads. It may or may not account for production costs too, depending on your business and the inventory accounting methods you employ.

The landed cost metric is helpful for businesses because it produces an accurate picture of a product’s total cost.

By knowing your landed costs for each item that you sell, you can more easily set appropriate prices without the risk that hidden post-production fees (like export duties) will eat into your profit margins.

Landed cost vs standard cost

Standard cost usually refers to a predetermined (estimated) cost for production. Standard cost considers standardised, expected costs for raw materials, labour, and overheads.

Landed cost, on the other hand, is the actual cost to ship a product to your customers.

Standard cost is useful for internal planning but can be detrimental when attempting to calculate true business costs.

What factors go into landed cost?

The method for calculating landed costs can vary. Some manufacturing accountants include production costs in the calculation, while others do not.

For some businesses, landed cost is associated primarily with the supply chain – considering only the cost to procure, transport, and deliver a product. For others, landed cost factors in production and equipment costs as well.

Key factors typically included in landed cost:

- Raw materials

- Freight charges

- Customs duties and taxes

- Shipping insurance

- Inventory carrying costs

- Handling fees and port charges

- Compliance-related costs

- Payment processing fees and exchange rates

- Operational overheads

Production costs such as labour, equipment, and maintenance fees may or may not be included depending on the business model.

Does landed cost include tax?

Yes, landed cost includes tax. All taxes and duties associated with shipping an item add to your landed cost. This makes the landed cost metric essential for businesses shipping units overseas.

Landed costs include any taxes, freight, and insurance costs as well as the standard costs to produce and sell a product.

Landed costs include any taxes, freight, and insurance costs as well as the standard costs to produce and sell a product.

What doesn’t landed cost include?

Landed cost does not typically include costs that are not directly related to the production and sale of a single item, or costs that are difficult to ascertain an exact value for.

Cost factors that landed cost may not include:

- Production costs (sometimes)

- Research and development costs

- Marketing and sales costs

- Administration fees

- Sustainability costs, unless they’re rolled into shipping costs

- Returns and warranties

Why is knowing your landed cost important?

Landed cost is important because it enables you to accurately price products to get the maximum return. Accurate pricing facilitates healthy cash flow and helps you avoid losing money on hidden costs.

Knowing your landed costs also helps you to make better decisions about where you spend your capital.

While production and shipping costs are useful figures in isolation, your exact profitability can only be determined by combining them to find your landed costs. This can then be subtracted from your income for an accurate measure of your margins, which can in turn influence budget allocation.

Costs associated with shipping products overseas often include hidden extra costs – tariffs, customs fees, and exchange rates are three common examples. Identifying these hidden costs will help you better plan spending and marketing activities.

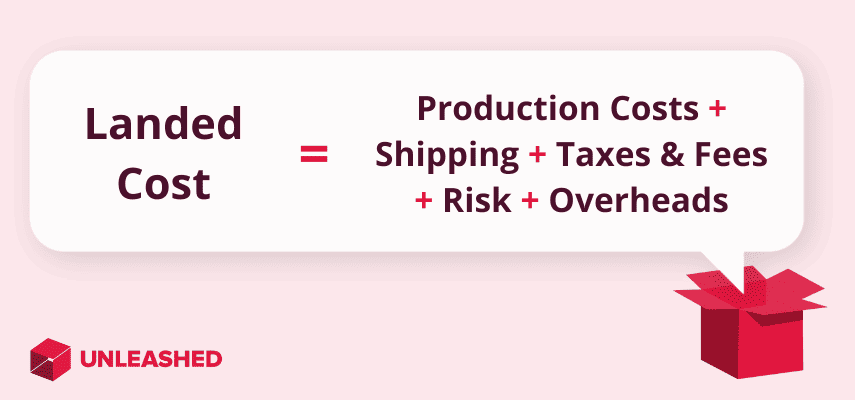

How to calculate landed cost

To calculate landed cost, use the landed cost formula:

Manufacturing Costs + Shipping + Taxes, Duties & Customs Fees + Risk + Overheads = Landed Cost

This will give you the landed cost for a bulk quantity of goods.

Divide the answer by the number of units to get a per-unit landed cost.

Example: Calculating prices with and without landed cost

Here is an example of how your margins may be skewed when you don’t consider landed cost:

|

Without Landed Cost |

With Landed Cost |

|

|---|---|---|

|

Cost to produce |

$1000 |

$1000 |

|

Shipping-related costs |

Not calculated |

$300 |

|

Selling price |

$1,250 |

$1,250 |

|

Calculated profit |

$250 |

–$50 |

As you can see, without factoring landed cost you may be selling at a loss without realising it.

How to minimise your landed costs

Reducing your landed costs is one of the best ways to increase profit margins and strengthen your cash flow. Here are some effective ways you can do that.

1. Optimise your distribution methods

The methods you select for getting your goods to customers have a major impact on how much it costs to sell. Look to your third-party service providers and shipping strategies for cost-saving opportunities.

Some useful questions for assessing your distribution processes:

- Can you get a better deal on raw materials or transport costs?

- If you manage your own logistics, have you optimised transport routes to eliminate unnecessary extra travel time and fuel usage?

- Would any offshore processes be cheaper onshore?

- If you need an offshore presence, could you invest more in that region to establish, for example, a local warehouse or production facility?

- What tools and software are available to help improve last-mile delivery?

Remember: Even small savings on the shipping side of your operations can result to major improvements in product profitability.

2. Monitor, analyse, and improve supplier performance

Supplier management is essential to optimising your landed costs. If certain suppliers aren’t fulfilling the expectations outlined in your contract – or their performance is slipping – you risk higher costs and restricted profits.

While long-term, friendly partnerships with suppliers can be of great benefit, it may be time to renegotiate contracts (or find an alternative source) if they’re not meeting your required standards.

3. Call in the experts

A common trap to fall into in business is assuming you’re better off doing everything yourself.

While this may be a necessary challenge for brand-new businesses, it can lead to productivity losses over time. Eventually, you’ll find you’re doing 100 things poorly and very few things well.

One way to increase efficiency and reduce landed costs is by investing a little more in the right expertise.

Whether that means hiring new staff, employing the services of a third-party provider, or simply upskilling your existing staff with essential training – you’re going to discover that handing key tasks over to the experts can save you loads of time and money.

In addition to bringing down your landed costs, this strategy can also reduce your supply chain risk.

4. Draw up a risk management plan

Speaking of supply chain risks, it’s important to develop a strategy for mitigating them.

There are always risks inherent in transporting goods. Putting time into a risk assessment plan will help you lay out all the potential risks involved in procuring and shipping your goods.

Organise supply chain risks by likelihood and their potential impact on your bottom line.

From there, you can determine the risk controls available to mitigate the identified risks which are both highly likely and highly damaging, while giving yourself room to ignore the low priorities until you have the time to deal with them.

5. Invest in technology and automation

Calculating landed cost is a complex and time-consuming task when performed manually.

Even using spreadsheets becomes tedious and messy once you hit a few hundred product sales.

Inventory management software like Unleashed is essential for calculating your landed costs with minimal admin time and maximum accuracy. You can use it to automate the entire process of calculating product costs, analysing supplier performance, and identifying key sales opportunities.