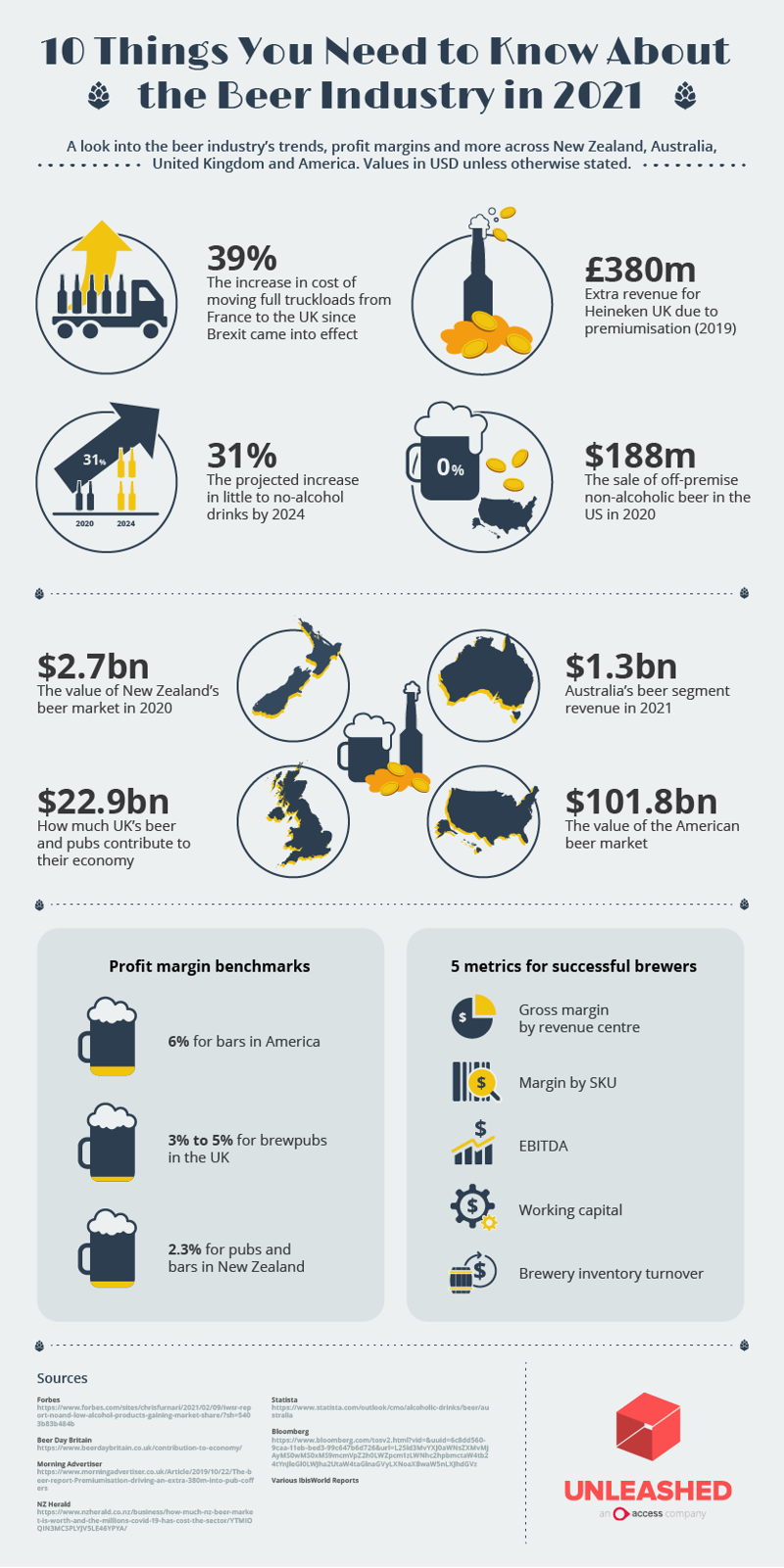

With so many competitors in the beer industry, how do you make sure your brewery survives and thrives? Here we’ll tell you all you need to know about brewery profit margins – and much more, including how to price your beer, and how to track and optimise your performance with brewery software.

We’ll start by looking at some key statistics across the Australian, New Zealand, UK and US markets. Then cover:

- Brewery profit margins and how to calculate them

- Tracking brewery costs

- Pricing strategies for beer

- How to boost your brewery’s profit margin

Beer industry performance by country

The Australian beer sector in numbers

85% of beer sold

Approximately 85% of the beer sold in Australia is made domestically. Australia’s beer sector is a significant driver of economic activity and domestic jobs, from farming, brewing, packaging, and distribution.

US$6.04

In Sydney, a pint of beer will cost you on average US$6.04. That’s almost double the average cost of a pint in the most populated cities globally.

79% of sales volume

In 2019, three major local brewers, CUB, Lion, and Coopers, accounted for 79% of sales volume. The beer industry in Australia is highly consolidated, with these top three players dominating almost 91% of the market.

17.7% profit margin

With a market value of about US$11.5 billion in 2020, the industry has a profit margin of 17.7%. By comparison, the US market is worth almost 10 times more yet only has a 2.7% profit margin.

6.2% industry growth

Craft beer production in Australia has grown 6.2% over the past five years thanks to the shift towards premium beers and a growing emphasis on quality. However, the Covid-19 pandemic has put a damper on the industry since March 2020, with government-imposed restrictions limiting on-trade sales.

19.9% profit margin for craft beer

Craft beer is increasing in popularity and availability in Australia. It has a 19.9% profit margin and accounts for around 23% of the market.

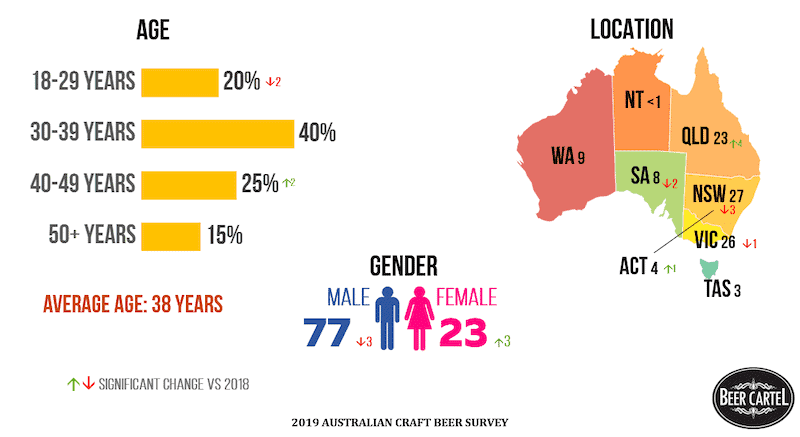

A snapshot of the Australian craft beer scene in 2019 based on a survey by Beer Cartel

A snapshot of the Australian craft beer scene in 2019 based on a survey by Beer Cartel

45% on-premise spend

By 2023, 45% of spending in the beer industry will be attributed to out of home spend, namely in bars, pubs and restaurants.

4.8% profit margin for liquor retailers

Liquor retailers sell packaged beer, wine, spirits and ready-to-drink mixes. The industry includes both online and physical retailers. Australian liquor retailers have an average industry profit margin of 4.8%. The industry has several challenges such as lower alcohol consumption, rising health consciousness and competitive pressures. Despite these trends, liquor retailing is expected to grow 1.5% from 2015 to 2020 largely due to increasing consumer demand for higher value, premium drinks.

1.8% profit margin for liquor wholesalers

Liquor wholesalers buy beer, wine, spirits and other alcoholic drinks from manufacturers, and sell them to pubs, bars, supermarkets and other liquor retailers. Liquor wholesalers have a smaller profit margin of 1.8%, relative to liquor retailers. This can be attributed to brewers bypassing wholesale and selling directly to retailers, and pricing competition among downstream retailers.

The New Zealand beer sector in numbers

$2.3 billion

The New Zealand beer industry is worth NZ$2.3 billion dollars and is made up of 218 breweries. The industry employed around 22,000 people both directly and indirectly in 2019 and paid $600 million in GST and excise tax.

4.6 breweries for every 100,000 people in the country

By 2019, New Zealand had 4.6 breweries per 100,000 people. That’s more breweries per capita than any other country. In a global comparison, the UK has 3 breweries for every 100,000 people, Australia 2 per capita and the United States 1.96.

$2.3 billion

In Auckland, New Zealand’s most populous city, a pint of beer will set you back US$6.25 on average.

6.2% profit margin

New Zealand’s beer industry has a profit margin of 6.2%.

3.4% profit margin for liquor retailers

New Zealand liquor retailers primarily sell packaged beer, wine or spirits for consumption off the premise only. It includes physical retailers’ online sales, but excludes purely online businesses. New Zealand liquor retailers have a 3.4% profit margin. Rising demand for premium products, including craft beer, has supported the industry’s revenue. However, alcohol consumption has been flat, largely reflecting consumers’ health consciousness.

2.3% profit margin for pubs, restaurants and clubs

On average, the New Zealand pub, restaurant and clubs industry has a 2.3% profit margin. Expanding discretionary income and population growth in the 18 to 25 year old group has offset the trend of falling per capita alcohol consumption.

21% rise in craft beer

Stats NZ has reported the volume of high-strength beer (more than 5% ABV) available for consumption has increased by 21% in five years. This includes most craft ales.

Projected 43% decrease

On-trade beer sales volumes — that includes outlets like bars, restaurants, pubs, and clubs — are expected to fall by 43% in 2020 in light of Covid-19. Before the pandemic, on-trade distribution was expected to rise by 4%.

The UK beer sector in numbers

US$22.628 billion revenue

In the UK, beer is a US$22.6 billion industry. Beer and pubs contribute £22.9 billion annually to the country’s economy. The alcohol industry in general accounts for 2.5% of total GDP.

- Check out this cool interactive tool created by the British Beer and Pub Association to show the impact of beer tax on the UK economy, job market, wallet of the consumer and the brewer

17.8% profit margin

The UK beer industry has an average profit margin of 17.8%.

14.7% profit margin for craft beer

Craft beer is still performing well, averaging a 14.7% profit margin.

2.9 million hectolitres

In 2019, the UK consumed just under 2.9 million hectolitres of premium craft beer, an increase of 3% over the past few years. That’s over 500 million pints! Premium craft beer makes up about 6.5% of the total beer market in the UK.

73% of sales spent out of home

By 2023, 73% of spending will come from out of home consumption. In 2019, there was a modest 0.8% increase in the number of pubs in the UK in 2019— the first rise following over a decade of decline. This reflects a growing movement of small brewers taking on their own retail premises and taprooms. The Society of Independent Brewers’s 2020 craft beer report showed that in 2019, their members reported acquiring 47 pub sites; 30% of them now have a taproom, and 35% of them have a shop.

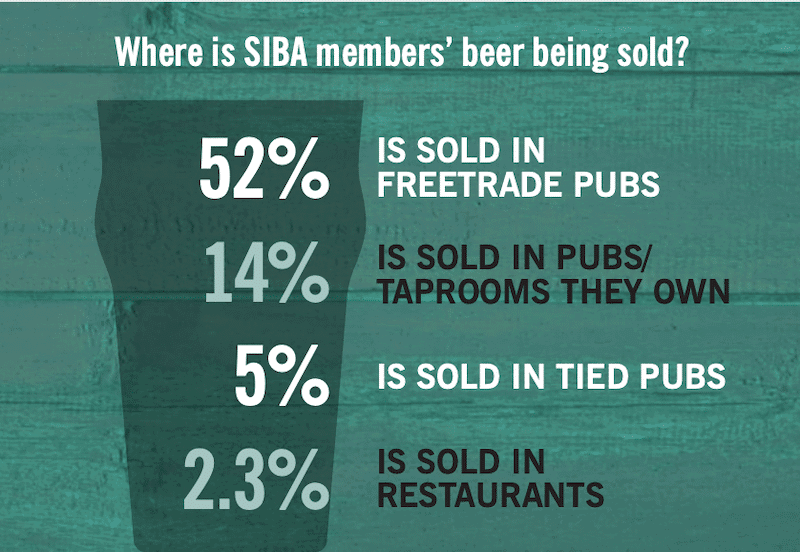

2020 SIBA Members’ Survey showing craft brewers’ routes to market

2020 SIBA Members’ Survey showing craft brewers’ routes to market

3.5% profit margin off-trade

Off-trade sales in the UK had an average profit margin of 3.5%. In the second quarter of 2019, off-trade sales were reported at approximately 4.1 million barrels of beer, a decrease compared to the same time in the previous year.

3.4% profit margin on-trade

On-trade sales in the UK had an average 3.4% profit margin. Brewers feel that selling through distributors (i.e. off-trade) delivered lower profit margins, according to a 2019 SIBA report. Many brewers are turning to direct retail to drive more revenue.

US$6.44

In London, it will cost you US$6.44 for a pint of beer in an “expat” neighborhood pub according to Finder.

The US beer sector in numbers

US$101.8 billion

The US beer industry generated US$101.8 billion in 2020, and the market is expected to grow annually by 7.5% from 2020 to 2023. Globally, the US generates the most revenue from beer sales.

2.7% profit margin

In 2020 the beer industry had an average profit margin of 2.7%.

4.1% profit margin for wholesalers

Off-trade distributors had an average profit margin of 4.1%

6% profit margin for bars and nightclubs

On-trade distributors in the US had an average profit margin of 6%

US$7.52

In New York, a pint of beer will set you back US$7.52.

4% profit margin for craft beer

In 2020 the craft beer sector had an average profit margin of 4%.

13.6% of the beer market

Overall, beer volumes decreased 2% in 2019 but craft brewer sales grew at a rate of 4% by volume, reaching 13.6% of the beer market by volume. Craft production grew the most for taprooms.

4.4% industry growth

Craft beer industry revenue has increased at a rate of 4.4% to $7.6 billion over the past five years. It is now one of the fastest-growing and most popular alcoholic beverage segments in America. Brewers have captured the drinkers that have traditionally purchased light and premium brand beers. Similarly, consumers are drawn to craft brewers, microbrewers, and local brewpubs because of their attention to detail, range of beer styles, quality of ingredients and their high degree of expertise.

Brewers Association breaks down the US beer production volume in 2019

Brewers Association breaks down the US beer production volume in 2019

Brewery profit margins

Two types of profit margin you should know

Profit margins determine how much profit you’re making as a percentage of revenue, after taking costs into account. Profit margin is expressed as a percentage — the higher it is, the more profitable you are. They are often presented with other profit ratios and KPIs to paint a better picture of a business’ health. There are two types of profit margins you should know: gross profit margin and net profit margin.

Gross profit margin

The gross profit margin is what’s left over after you deduct the cost of brewing your beer; if you’re running a brewpub model, you will also need to take into account the cost of food sold. This calculation excludes other costs such as overhead from the office, taxes, and interest on debt.

Gross profit margin can be calculated using the formula:

Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue

According to binwise, the average gross profit margin for bars and nightclubs (on-trade) is 70% to 80%.

Net profit margin

The net profit margin is the percentage of profit generated from revenue after accounting for all expenses and costs. Net profit margin is calculated using the formula:

Net profit margin = ((Revenue - COGS - Operating expenses - Interest - Tax) / Revenue ) x 100

The average profit margin for your business will depend on what type of establishment you’re operating as pure breweries and brewpubs will have different revenues and operating expenses.

If you run different types of business models – for example, if you have both a brewpub and a production facility – make sure you calculate gross margin for each one separately. You should also be tracking margin for each product you sell — that’s how you’ll know which brews are the most cost-effective and which aren’t performing so well.

What’s the average profit margin for a bar?

In America, the bar and nightclub market is valued at US$24 billion and average profit margins are 6% With over 59,000 businesses in this industry, it’s highly saturated and competitive. Unfortunately, there is no agreed-upon benchmark for profit margins. It all depends on the model you’re running and where you’re located.

All pubs are unique and have their own running costs. Euroboozer, a UK importer of craft-brewed beers, states that for a London pub or bar gross profit has to be around 70% in order to be sustainable.

Here’s how the British Beer and Pub Association have categorised the five types of pubs and their typical running costs.

What’s the average profit margin for a taproom?

The Brewers Association defines a taproom brewery as a professional brewery that sells at least 25% of its beer on-site and doesn’t operate significant food services; beer is brewed primarily for sales in the taproom.

There’s no magic number to determine what profit margin a taproom should be making but here’s an example of how you can calculate profit margins for a taproom.

Let’s assume you run a brewery and sell your beer to your taproom for $100 per quarter barrel keg. This will yield you 62 pints (of 16 oz). You sell a pint for $6 and total sales on a quarter barrel come to $372.

Gross profit margin = ((Revenue - COGS)/Revenue) x 100 = ((372 - 100)/372) x 100 = 73%

Your gross profit margin is 73%, meaning that you’re retaining 73% of your revenue after accounting for costs.

Now let’s add in operating expenses to calculate the net profit margin. We’ll assume that operating expenses, tax and interest cost you 40% of your revenue, making it $149.

Net profit margin = ((Revenue - COGS - Operating expenses - Interest - Tax) / Revenue ) x 100 = ((372 - 100 - 149) / 372 ) x 100 = 69%

You have a net profit margin of 69%. You can calculate net profit margin and gross profit margin year on year to see how your taproom’s profitability has changed. You can also use these metrics to benchmark against similar taprooms in your neighbourhood.

What’s the average profit margin for a brewpub?

According to the Brewers Association, a brewpub is a restaurant-brewery that sells at least 25% of its beer on-site and operates significant food services. The beer is brewed primarily for sale in the restaurant and bar and is often dispensed directly from the brewery’s storage tanks. Read more about beer logistics and supply chain here.

The main difference between calculating profit margin for a taproom and a brewpub is that you now have to include the cost of selling food.

Food has a lower profit margin than alcohol because it isn’t marked up as much as alcohol is. In addition, you now have to factor in the cost of maintaining a kitchen, hiring skilled food service workers, getting the right licenses and more. If you don’t know the benchmark for brewpubs in your area, you can compare it to restaurants; azcentral reports full-service restaurants achieving margins between 3% to 5%.

Listen to this Unleashed podcast with Maria Pearman on the brewpub model — and how to get it right. The discussion on brewpubs begins at 16:21.

Unleashed Software · Ep16 - Building A Good Brewery Through Better Data

Calculating beer profit margins

Efficient brewers want a speedy and accurate way of calculating beer profit margins. There are three methods: spreadsheets, online calculators, or inventory management software.

Spreadsheets

Spreadsheets are a basic, free method that may suit new and small brewers. However, it can soon become unwieldy managing multiple spreadsheets as the brewery grows.

Online calculators

There are a few online profit calculators out there such as these examples by Eagle Distributing, Floodlight and Del Papa Distributing Company. They’re good in a pinch but they don’t take into account costs such as packaging and materials costs, labour costs, or even storage costs.

Brewery management software

The gold standard for brewers everywhere. Brewery software will capture all the costs of production, from raw materials to freight costs. It will also report on your margins across each product so you have a full picture of your performance. Check out how ShinDigger Brewing Co. grew their brewery using inventory management software.

Take it one step further with business intelligence tools like Unleashed’s Business Intelligence module. This takes your data from sales, purchases, inventory, suppliers and production, and turns it into actionable insights for you to slice, dice and visualise.

Unleashed's BI module helps brewers capture, analyse and visualise their data with sophisticated brewery software

Unleashed's BI module helps brewers capture, analyse and visualise their data with sophisticated brewery software

Understanding your brewery’s costs

The cost of making beer includes labour, materials and overhead — but brewers know it’s not as simple as that. Keeping track of all the expenditure that goes into making beer can be challenging for new and small brewers, but understanding these costs will put profitability into perspective. It’s the key to growing a healthy brewery and maximising efficiency.

Direct material costs

Material costs is the price paid to acquire materials, such as ingredients and packaging materials, including tax and freight. It also includes any indirect costs of storing raw materials.

Direct labour costs

Labour costs include salaries and wages of employees involved in brewing, production and packaging. Don’t forget to include costs related to employees, such as benefits and payroll taxes.

Overheads

Overhead costs include costs such as rent, utilities, phone bills, depreciation, insurance, repairs, property taxes, accounting fees, interest, legal fees and more.

This is the trickiest to quantify because it’s an indirect cost and hard to pin against a single unit of product. It also comes in the form of a bill for the whole company and not just for each department. This is especially important if you have an administrative office, production site, and a brewpub: You have to decide how you want to split the cost between each department. To do this, you might want to engage an accountant to discuss the best approach.

Read more

- The Complete Guide To Calculating Total Manufacturing Costs

- 10 Ways Manufacturers Can Reduce Manufacturing Costs

How to cost your products

Direct materials, direct labour and overhead costs are all captured in a beer’s production recipe, known as the Bill of Materials. Costing and tracking it doesn’t have to be hard work. The simplest way to cost your beer is to use brewery software that does it for you.

In addition to using the right software, you need to conduct regular stocktakes (and do them right). It’s one of the most important ways you can control your production costs. Counting your inventory helps you make sure you have the right quantity of raw materials and components on hand so you don’t end up with missing inventory. Missing inventory can see your production suffer and you’ll have to write it off. It’s an expense that lowers your net income.

The average price of beer across the world has been steadily increasing from US$2.39 in 2010. According to predictions by Statista, it will reach $3.50 by 2023.

How to price beer

Setting prices for your beer is tough: set prices too high and you might drive customers away. Set them too low and you miss out on revenue. Ideally, you should price your beer using tried and tested pricing strategies that apply across a broad range of industries, use industry-standard markups, or a mix of both.

Choosing the right pricing strategy

Here are the five pricing strategies that are most applicable to pricing beer.

1. Competitive pricing strategy

Also known as competitor-based pricing, this pricing strategy uses the competitors’ prices as a benchmark. It doesn’t consider product demand or costs of production. With this strategy, you can price your products slightly below your competitors’, at the same price, or slightly above your competitors’.

The beer industry is saturated: the top five market leaders account for almost 60% of global volume of beer; half of this can be attributed to market leader AB InBev alone. Craft beer isn’t spared either. With slowing sales and volume, the signs point to a maturing industry.

For brewers and beer retailers, a competitive pricing strategy can be useful since a slight price difference may be the deciding factor for customers.

2. Value-based pricing strategy

A value-based pricing strategy is when you price your products based on what your customers are willing to pay. To use this strategy effectively, you need to know your customer profiles so you can align your prices with customer sentiment and loyalty.

We only need to look at Pabst Brewing Co. to see how understanding what your customers value can benefit you. Pabst Brewing Co. is a 176-year-old American brewery that makes Pabst Blue Ribbon (PBR). PBR isn’t unique — as a cheap beer, it’s low in alcohol and watery in flavour. It was popular in the 1970s but sales gradually dropped, until it hit a low in 2001.

However in an unlikely comeback, PBR sales rose by 5.3% in 2002. At the heart of the PBR revival were hipsters, a subculture made up of cool young urbanites who support under-the-radar brands and music. The typical PBR drinker had changed from old guys to hipsters. The latter placed a high value on PBR because it became cool to drink “uncool” beer and support the underdog. More importantly, they were willing to spend a little extra to maintain this image. For Pabst, this justified price increases. By 2013, the price of PBR was up by 11.5%.

3. Cost-plus pricing strategy

A cost-plus pricing strategy, also known as a markup strategy, focuses on your cost of goods sold; it’s the opposite to value-based pricing.

This is a common pricing strategy because it’s so straightforward. You add up all your production costs, fixed and variable, and then apply a markup percentage to get the final price. For example, it costs you $30 to make a six-pack of beer and you want to make a profit of $15 on each sale. You’d set a price of $45, which is a markup of 45%.

While widely used, it has its drawbacks. Firstly, it is not guaranteed to cover costs or earn a profit. Managers often have to forecast sales volume and the fixed costs associated with each unit. Depending on how reliable and accurate the forecast is, the cost-plus price can easily be too high or too low. Secondly, this pricing strategy doesn’t take into account the customer’s willingness to pay nor competitors’ prices.

4. Premium pricing strategy

This strategy is similar to the value-based pricing strategy. You can price your products high to present the image that your products are premium or of high value. This strategy focuses on the perceived value of a product instead of the actual value or production cost.

In a diverse and rapidly growing industry, there is no agreed-upon definition of premium and super-premium beers. In China, the difference between premium and super-premium beer is its price. In the UK, the definition of a premium beer depends on its alcohol content, while the definition of super-premium is dependent on its price. Ultimately, the concept of premium is in the mind of the consumer.

The global premium beer market value is expected to reach US$55.86 billion by 2024.

Luckily for the beer industry, it is currently going through a premiumisation trend where beer lovers buy more expensive beer. Over the past four years, alcohol consumption has dropped steadily, as people are becoming more health-conscious. Yet, the value of sales has increased.

For mature segments in the industry, premiumisation corresponds to a desire for authenticity, where consumers want a clearly defined local origin. For emerging segments, premiumisation corresponds to status-oriented consumption. Consumers use the brand and price level to show off their self-image and identity.

5. Multichannel pricing strategy

A multichannel pricing strategy is where you offer customers different prices depending on where they chose to shop. A common practice is to offer customers lower prices via an online channel.

MIT Sloan Management Review reveals that retailers who price differently across all channels see bottom-line growth of 2-5%. The key challenge is understanding what your customers want in each channel and how that affects what they’re willing to pay.

Each channel has different considerations. Historically, brewers have focused on on-trade distribution because it yields higher profit margins. But the focus is now on off-trade distribution channels. In 2019, off-trade sales trumped on-trade sales by 700,000 pints in the UK.

Let’s not forget about the potential eCommerce has for brewers. The online alcohol market has grown 20% year on year over the past 10 years — five times the growth rate of overall off-trade alcohol sales. This is likely to increase because of the Covid-19 pandemic, which has stunted on-premise trade for many brewers. Brewers aren’t strangers to eCommerce. The likes of the UK’s Crate Brewery and Kiwi brewers Behemoth Brewing Company established their online presence well before the pandemic hit.

Apply industry standard pricing methods

In addition to the pricing strategies above, here are some industry-standard pricing methods.

How to price craft beer

To calculate the menu price for craft beer, all you have to do is multiply the wholesale cost by two or three: if it’s a high-cost beer, multiply it by two, and if it’s a lower-cost one, multiply it by three. This is your wholesale multiplier. Expressed as a formula:

Drink price = Wholesale cost ($) x Wholesale multiplier

For example, Eddy manages a taproom and he orders a batch of seasonal brews for $5 each and some IPA for $4 each. Eddy knows the seasonal beer is more premium so he multiplies it by three to get the drink price of $15. To figure out how much he should sell the IPA for, he multiplies it by two to get the drink price of $8.

You can also add an overhead service charge on top of your wholesale multiplier to get the menu price. Some bars and pubs in upscale locations do this because they offer a better experience. Expressed as a formula:

Drink price = Wholesale cost ($) x Wholesale multiplier + Overhead service charge

Using the previous example, Eddy knows he has an overhead service charge of $1. To figure out how much he can sell the seasonal brew, taking overhead service charge into account, he uses the formula to arrive at a total of $16.

How to price bottled beer

If you know your target pour cost and what it costs for the beer, you can set the drink price using the formula:

Drink price = Ingredient Cost ($) / Target Pour Cost (%)

Aim for a pour cost of 20% to 30%. For example, Daisy is a brewpub owner and she orders 100 6-packs of beer from her brewer for $150, and wants to have a pour cost of 20%. She determines her price by dividing the cost of her drinks by the target pour cost, which arrives at the price of $7.50 per beer.

How to price draft beer

Use the same method as either bottled beer or craft beer but introduce higher overhead charges or markup. This is because installing and maintaining a draft system is costlier than ordering bottles or cans. You’ll also need to take into account spillage, over-pouring and spoilage — this happens more often when serving draft beer than with canned or bottled beer.

Pricing beer is a delicate balancing act

Pricing beer is a delicate balancing act

9 factors to keep in mind when pricing beer

Pay attention to pour costs

Pour cost measures the gross profit margin on your alcohol. Understanding pour costs helps you identify inefficiencies and adopt the strategies to improve it, whether that’s by setting different prices or minimising costs. The pour cost range for craft beer is around 20%.

Pour costs can be calculated using the formula:

Pour cost = (Inventory usage / Total sales) x 100

Inventory usage is what you’ve used in the given time period, expressed in dollars. That can be determined by adding your starting inventory to your received inventory, then subtracting your ending inventory.

For example, Daisy started June with $100 worth of beer and bought $300 worth of beer during June. At the end of June, she has $250 worth of beer left. Her inventory usage for June is $150.

During June, she made $3000 worth of sales. Plugging these numbers into the pour cost formula, Daisy determines that in June, her pour cost was 5%. This tells her that she is making 95% in gross profit. In other words, for every $1 of beer she sells, she makes $0.95.

Consider rotating what’s on offer

Changing what’s on offer can keep your customers coming back. Rotating your offer also lets you experiment with different types of beers at more premium prices.

Factor in alcohol volume

Beer with higher alcohol volume (typically craft beers) can seem more attractive to patrons and can justify a higher price point. For this to work, you need to understand your customer demographics, needs and what they value.

Spotlight special beers

If you’ve got seasonal, rare or small-batch brews, you can use this opportunity to offer premium value at a higher price, create marketing buzz around them and bring in more customers.

Don’t forget about taxes

Consider factoring taxes into your sell price. But be careful not to alienate customers that are looking for cheap beer.

Keep track of total costs

You should be keeping track of how much your beer costs to produce. Not just the cost of hops and yeast, but also labour and packaging. This creates an accurate picture of the cost of beer so that it’s easier to set a price that maximises profit margins.

Offer a variety of prices

Your brewpub or taproom might carry a range of craft beer. One of the biggest mistakes brewers make is not offering enough price points, especially when premiumisation is key in the industry.

Your markup should be different for each type of brew you have. Customers who like small-batch brews or super premium beers won’t mind paying more because of the perceived quality and value. You might also have customers who prefer mainstream beer and won’t pay anything more than the average. Don’t anchor your prices by introducing too low a price point.

Use the power of context

Where you are affects what you pay. Economist Richard Thaler found that customers were willing to pay more for a Budweiser if they knew it was coming from an upscale hotel versus a run-down grocery store. This means that you should choose the right mix of retailers to stock your products. If you’re selling through a niche brewpub, an exclusive online reseller or in your own specialty store, you can command higher prices.

Keep an eye on your competitors

Keep your finger on the pulse by looking at your competitors’ prices to make sure they aren’t wildly different to yours.

How to improve your brewery’s profit margin

Lightspeed studied more than 13,000 retailers across different industries and countries and found that the average gross profit margin is 53.33%. However, when comparing across industry verticals, alcoholic beverages had some of the lowest margins at 35.64%. Here are four strategies to boost your profit margin.

1. Turn your data into dollars

Whether it’s identifying your best selling beer, spotting inefficiencies in the brewing process or rewarding your best salesperson, making data-driven decisions can boost beer profit margins.

Some key KPIs breweries should monitor include:

- Gross margin by revenue center

- Margin by SKU

- EBITDA

- Working capital

- Brewery inventory turnover

Check out this Unleashed Q&A with brewery accounting expert Maria Pearman to learn more about the KPIs brewers should be tracking, and how the industry can prepare for the future.

2. Sell directly to consumers

With so many brewers clamouring to get their beers in stores, shelf space is now coveted real estate. Small brewers might find it difficult to get into the distribution chain. This is where direct to consumer selling via an eCommerce store or through a taproom shines.

- Cut out the middleman and improve margins. Distributors are responsible for marketing beer and shipping it to other areas and will take a cut of your profit. If your brewery can distribute your beer locally, you get to keep more of the profit from sales

- Retain control of your brand. Distributors typically determine how and where to sell your beer. Self-distributing gives you total control over how and where your beer is sold; you can also make any changes quickly

- Receive instant feedback. Salespeople selling direct to consumers build better relationships and can get feedback directly from the source — a valuable asset for any business

Webinar: Watch our webinar on how to set up an online B2C store

Depending on your brewery, selling direct to consumers might be more appropriate. However, you’ll need to take into account

- Higher startup costs. You may be paying upfront for salespeople, delivery vans, equipment and warehouse

- Legal requirements. Check whether self-distribution of alcohol is allowed in your city or country, and what the requirements are

3. Don’t let your beer go to waste

Imagine you’ve spent the last two months brewing 1,200 6-packs of limited-edition beer. In the flurry of advertising, selling and distributing your beer, you’ve discovered that there 300 6-packs hidden away in the storeroom — they’re 3 weeks away from their “best by” date. You need to sell these leftover packs of beer at a heavily discounted price in order to move the stock and avoid a write-off.

As a general rule, craft beer is best up to three months from bottling or canning to optimise flavours and mouthfeel. Because beer has a limited shelf life, you need to make sure you have full visibility of stock so you can reduce wastage.

As part of food safety compliance, most countries will require you to have some sort of tracking system to make sure you can trace each batch as it goes through the production process, right through to when it is sold. Brewery software can keep track of raw materials such as yeast, malt and hops, as well as every keg, can or bottle.

Beyond tracking and tracing inventory, the right brewery management software will help you identify inefficiencies and opportunities for growth. Identifying and reducing waste directly improves the bottom line.

4. Review your prices

Joshua is a die-hard craft beer fan. He’s a frequent patron of your taproom and is often the first to try out newly released brews. Joshua will happily pay $12 for a pint because he loves the high-quality craftsmanship.

Chad is a university student looking for an interesting beer to try. He’s used to paying $20 for a 12-pack but he reluctantly pays $40 for a 12-pack of craft beer at your online store. Though he likes the taste, it strains his wallet — he can only buy your beer on special occasions.

Chad is more price-sensitive than Joshua. If your prices go up too much, he will switch to a different brand or a different drink altogether. Knowing this, you’ve decided to drop your prices on your eCommerce store and offer free delivery so you can capture more people like Chad. You also review your prices at your taproom and find that you can raise your prices because you have a better customer experience than your competitors’ taprooms. Joshua is still a happy frequent customer and even introduces some friends.

Customers in different sales channels have different values and price sensitivity. Make sure your prices reflect the needs of each group.

Read more