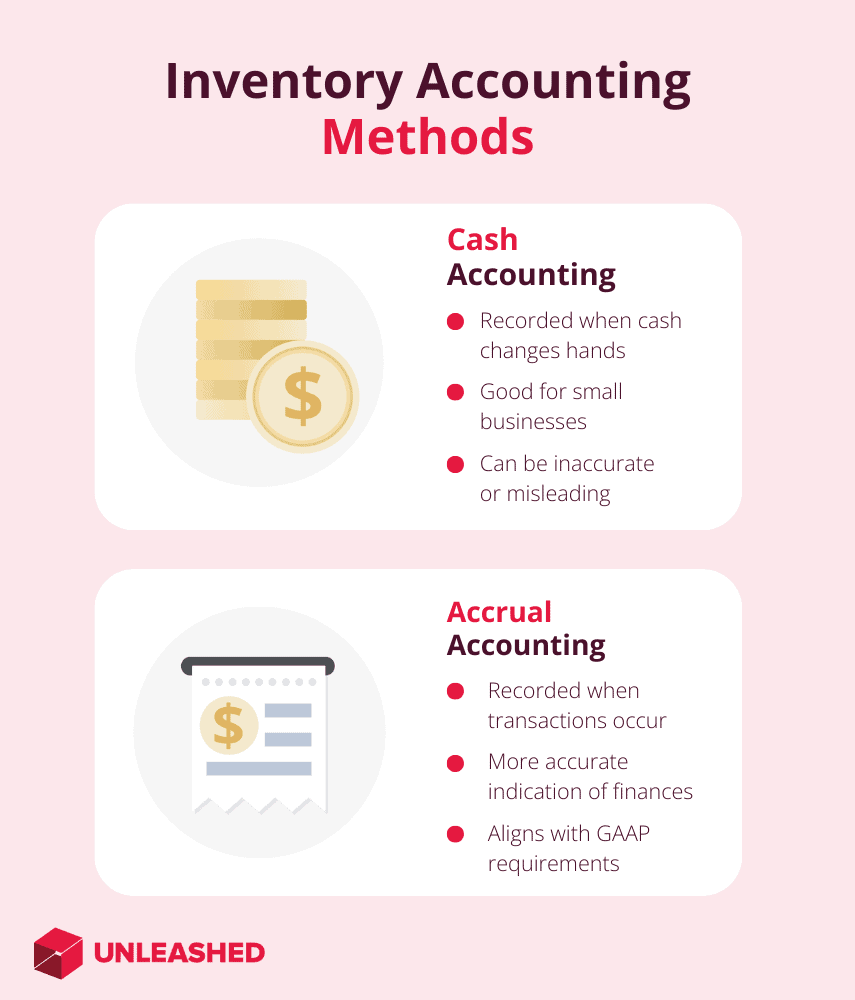

The inventory accounting methods used by a business directly affect any financial decisions you make.

Understanding the difference between cash basis vs traditional accounting will ensure you're using the most efficient method for your business model, size, and geographical location. So, let's break it down.

The difference between cash basis vs traditional accounting

The difference between cash basis vs traditional accounting is primarily the timing of when revenue and expenses are recorded in the account’s ledger.

Cash accounting records income at the time money is received. Expenses are recorded at the time money is paid out. Traditional accounting records income when it is earned whether money has been received or not and records expenses when they are incurred, regardless of when they are paid.

Simply put, cash accounting doesn’t document payables and receivables, traditional or accrual accounting does.

To help you make an informed choice about which method to use, let's take a more detailed look at the various definitions and applications for each of these methods.

- Learn more: Inventory Accounting Journal Entries

- Try for free: Inventory Accounting Software

What is cash accounting?

Cash basis accounting is an accounting method where income is recorded at the time cash is received, and expenses are only recorded when cash is paid.

The cash accounting method is commonly used by small businesses due to its simplicity. The method is more straightforward than traditional accounting, making it easier for business owners to manage the bookkeeping themselves.

Cash accounting also gives you a clear picture of cash flow and how much money your business actually has on hand. Large companies or organisations with substantial inventory are restricted from using the cash accounting method due to the potential it has to obscure the companies’ true financial position.

Cash based accounting pros and cons

Cash basis accounting offers many benefits for small businesses. The primary one is its simplicity and ease of use. As a small business or sole proprietor, you can manage your accounting with just a pen and a general ledger.

Because the entire accounting and financial reporting system revolves around cash flow, cash basis accounting can provide a better picture of cash flow projections.

There are also tax advantages since you are only recording business income and expenses as cash changes hands. You can hasten expenses or protract profits to legally lower your tax liabilities within financial time periods.

Cash basis accounting also comes with some clear drawbacks such as misleading and inaccurate reporting.

Your business can show a profit because you haven’t paid expenses even though you’ve incurred these costs within the time period.

Inventory is treated as an expense in cash basis accounting only becoming an asset when it is sold for cash. This may distort figures, especially if your business has its capital tied up in inventory, or you hold inventory stock for lengthy periods of time. This is why many countries do not allow cash basis accounting for businesses that maintain large inventories.

In the short term, cash basis accounting is often not as accurate as traditional accounting because transactions recorded on a cash basis will affect your books since there is a delay between when a transaction is completed.

Additionally, you could run the risk of potentially negative tax consequences because you can only deduct expenses that are realised within the current financial year.

Cash basis accounting is a lot simpler vs traditional accounting, but it's not permitted in certain countries and industries.

Cash basis accounting is a lot simpler vs traditional accounting, but it's not permitted in certain countries and industries.

What is traditional (accrual) accounting?

Traditional accounting, called accrual accounting, is an accounting method that allows a business to record revenue before receiving payment for goods sold and to record expenses as they occur.

Accrual accounting applies the double-entry accounting principle. It records income at the time the revenue is earned and records expenses when liabilities are incurred irrespective of when the cash is actually received. In the same accounting period.

Corporations and companies with large inventories or with revenues that average over the $20 million mark are required to use the accrual accounting method under Generally Accepted Accounting Principles.

The accrual accounting method gives you a more accurate indication of your company's current financial position.

Accrual accounting shows when your income and expenses occurred. It provides you with direct answers to questions about your expected inflows and outflows of cash, making it easier for you to manage your current resources and helping you to better plan for the future.

Traditional accounting pros and cons

The first advantage of accrual accounting is its transparency because it shows your accounts as they really are.

Secondly, accrual accounting helps to reveal future cash flow activities, providing you with a better representation of your business's financial health and simplifying strategic planning as a result. You can readily identify potential fluctuations in cash flow and plan ahead to prevent issues that a cash flow shortage can create.

The main disadvantage of accrual accounting is its complex nature which potentially makes it more expensive to implement.

Several rules must be followed, most of which are outlined by the Generally Accepted Accounting Principles and consistency is imperative for defining when and how to record particular types of income and expenses.

Additionally, completing your financial statements can be slightly more complicated under the accrual accounting method.

Traditional accounting is called the accrual method, and is compulsory for certain business types in some countries.

Traditional accounting is called the accrual method, and is compulsory for certain business types in some countries.

Cash basis vs traditional accounting: Which should you use?

The method you choose for your business will depend on several factors.

The nature of your business, the type of sales you make, and the amount of income you earn are all dynamics that contribute to the cash basis vs traditional accounting decision.

Depending on the nature of your business, you may not have a choice. The governments of many countries mandate that certain businesses use accrual basis accounting.

Here’s the short version:

- Cash basis accounting is generally better for SMEs, smaller not-for-profits, and businesses that don’t carry inventory as part of their daily operations. Cash basis accounting is great for freelancers whose accounting needs generally include invoicing a client and receiving payment.

- Corporations, large companies, and inventory-based businesses are better suited to the accrual basis accounting method. In many countries, accrual accounting is standard practice and often a mandatory requirement for these large, highly profitable organisations.

Cash based accounting is also a lot easier for new business owners and sole proprietors because you have reporting requirements and don’t have to pay tax on income until it’s received.

However, if you are a small business with plans to grow you may want to implement accrual basis accounting from the get-go so that you’re ready for future accounting obligations.

How to choose between cash basis and traditional accounting methods

When deciding whether cash basis vs traditional accounting is the best approach for your business, consider the following:

- The size of your business and the trajectory in which your business will grow. As it grows your accounting needs will change.

- The nature of your business and whether it is inventory-heavy. Organisations that are largely inventory-based are required to use the traditional (accrual) method of accounting for inventory.

- The degree of complexity around your business transactions and processes. The accounting method you choose needs to have the flexibility to equal this.

- The resources you have available to you and whether you can manage accrual accounting or have the means to implement technology that will support your accounting practices.

Getting the decision right ensures you can achieve accurate, consistent, and timely reporting of your business's financial position.

What businesses can and should use cash based accounting?

If you’re self-employed, a sole trader or a partnership business earning under the government stipulated threshold, you can use cash accounting.

The cash basis accounting method makes it possible to manage your own accounts because it simply records cash in and out.

For individuals, all income is accounted for on a cash basis. For self-employed business owners or partnership arrangements using the cash basis method, you need to include all payments received during the financial year, regardless of when the work was done.

For example, you manage your own business as an electrician, and you finished a contract worth $9,720 in April of the 2021-2022 financial year. Your client pays the invoice in August of 2022–2023 financial. Under the cash basis method, you record the $9,720 as income for the 2022–2023 financial year because that was the financial year the payment was received.

If you operate a small coffee shop or café type of business, you might prefer the cash basis accounting method for its ease and convenience.

Many café owners find cash basis accounting vs traditional accounting more practical since service and payment almost always occur simultaneously.

For example, small coffee shops or cafés receive cash payments immediately because customers pay for the food and beverages at the time they are provided. This means that their business transactions are recorded whenever cash is exchanged. They would not usually have any accounts receivable balances making it simpler to record the payments and revenues as they occur.

For inventory businesses, the traditional accrual based accounting method is usually the most effective model to use.

For inventory businesses, the traditional accrual based accounting method is usually the most effective model to use.

What businesses can and should use traditional accounting?

Inventory-based businesses such as ecommerce retailers, manufacturers, and wholesalers have the most to gain from traditional accrual-based accounting.

If you’re in the craft brewing or a craft distillery business, for example, you need to use the accrual accounting method because even a small brewery or distillery needs a reasonable capital investment. The brewing industry is inventory-heavy and has time-sensitive inventory.

The traditional method follows the matching principle and provides a clearer picture of how your business is tracking each month. Using the accrual accounting method provides a more accurate picture of your current financial position, recognising income and expenses in the same time period.

Your numbers won’t be skewed by late payments, giving you the confidence, you can cover expenses should anything go wrong with your next batch. You can see clearly if your business is profitable, and the accrual accounting method will help you to identify trends over time.

For example, you place a $5,000 purchase order for hops that won’t be delivered for two more months. Accrual accounting says that you have incurred the expense, therefore it must be recorded.

That $5,000 worth of hops from your supplier arrives and they are considered an asset until they are used. Once the hops are used and then your ale is sold, the hops become expense as a part of your cost of goods sold. Therefore, with accrual accounting, you can account for the expense when the asset is used.

Alternately, you send out crates of your latest sessional batch to one of your clients along with a 30-day invoice totalling $8,000. While you know that the customer will always pay, there are times when you must wait a bit longer than 30 days. Accrual accounting enables you to record the $8,000 sale as income even though it hasn’t been paid. You earned revenue, you record the transaction.