Previously a niche idea, 'dry July' has become the rage de jure for the squarest of corporates to the edgiest of musicians. At Unleashed it made us wonder, how do these sober beers translate to a brewer's bottom line?

We decided to investigate: looking at numbers for 39 indie brewers over the last four years to figure out if 'NoLo's' are as financially frothy as they would appear.

The results, it turned out, were clear. Breweries offering NoLos (defined as less than 0.5% ABV) saw more than 3x the revenue growth over the four year period, among other compelling figures.

No or low alcohol products are typically produced in two distinct ways; through arrested fermentation, where the process is cut short before alcohol is created, or reverse osmosis, where alcohol is removed from the product at the end.

Unleashed's Chief Executive Gareth Berry reckons that even with the significant costs involved with producing a clear-headed beer, they're still typically worth the hassle.

"On the face of it, the costs involved with producing a keg of NoLo and a keg of regular APA would look very similar. It takes more time and money to get a NoLo recipe consumers actually want, and the brewing and labour costs are often higher too. However, once that’s done you’ve got that ongoing advantage of not paying excise – which is only going up. If brewers can get it right, NoLo represents an exciting opportunity for our entire industry," said Berry.

The success of NoLo falls against a backdrop of increasingly expensive pints, due in part to the rising inflation levels, as well as excise taxes. The bubbling costs number among the many reasons why manufacturers will be considering adding a sober option to their brewing arsenal.

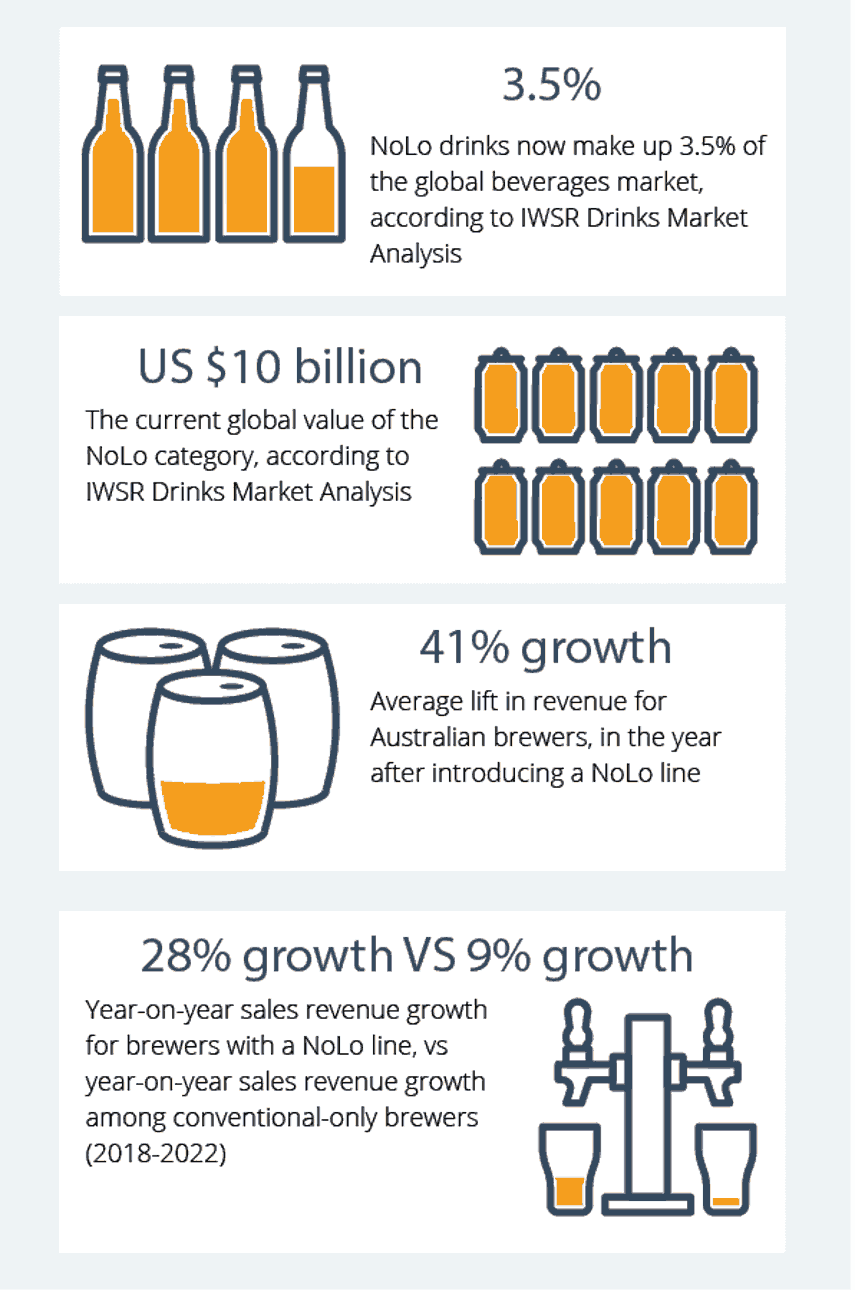

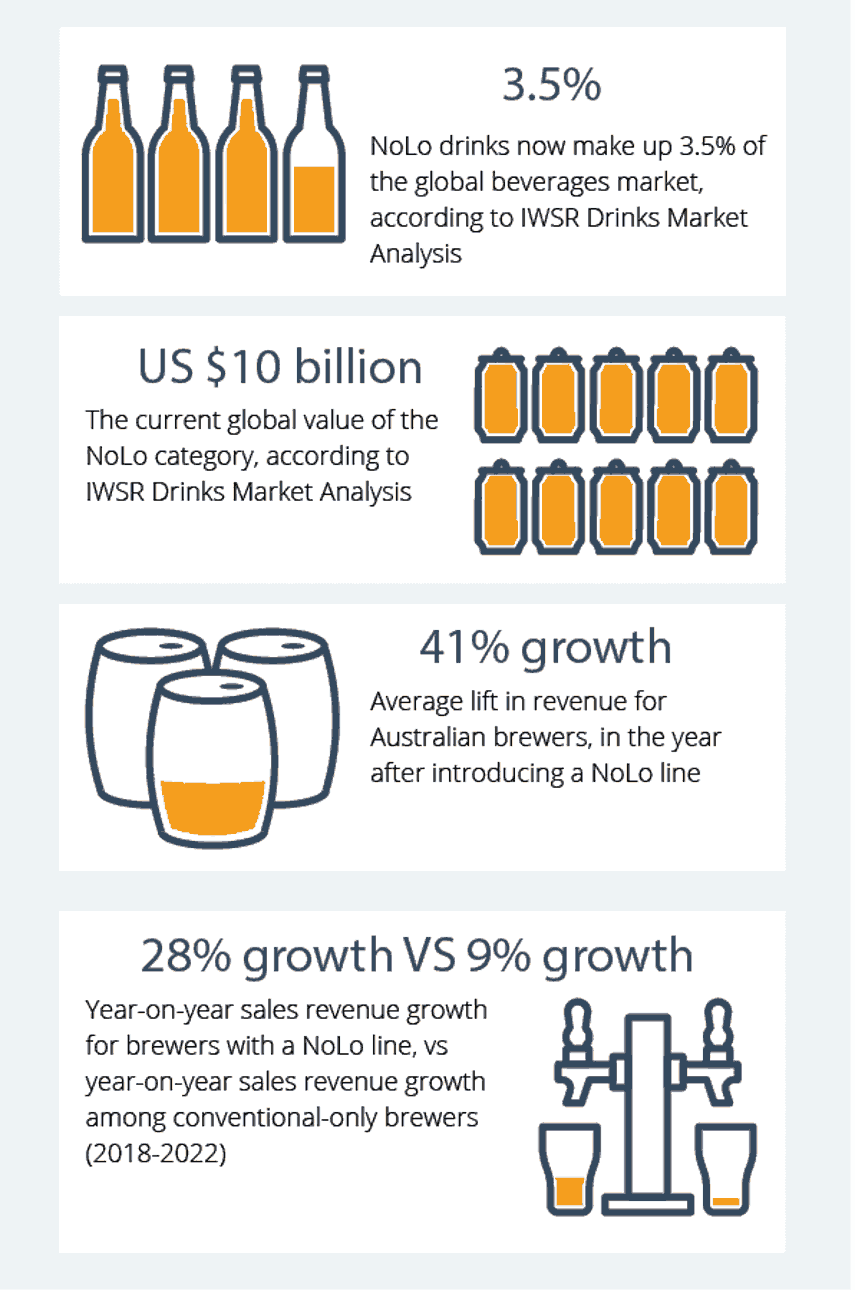

As more competition stirs, the quality of NoLo selection is improving, with all signs suggesting consumers are here to stay. Despite being a relatively boutique product – commanding a mere 3.5 percent volume share of the industry – the global NoLo market has soared to an estimated US $10bn.

“Independent brewers are seeing promising growth as is, but NoLo offerings have separated themselves as the clearest growth area in the frothy market. For our indie brewers that have done it tough these last couple of years, it’s opening up revenue streams and changing consumer behaviour,” said Unleashed Software’s Gareth Berry.

No or low alcohol products are typically produced in two distinct ways; through arrested fermentation, where the process is cut short before alcohol is created, or reverse osmosis, where alcohol is removed from the product at the end.

Unleashed's Chief Executive Gareth Berry reckons that even with the significant costs involved with producing a clear-headed beer, they're still typically worth the hassle.

"On the face of it, the costs involved with producing a keg of NoLo and a keg of regular APA would look very similar. It takes more time and money to get a NoLo recipe consumers actually want, and the brewing and labour costs are often higher too. However, once that’s done you’ve got that ongoing advantage of not paying excise – which is only going up. If brewers can get it right, NoLo represents an exciting opportunity for our entire industry," said Berry.

The success of NoLo falls against a backdrop of increasingly expensive pints, due in part to the rising inflation levels, as well as excise taxes. The bubbling costs number among the many reasons why manufacturers will be considering adding a sober option to their brewing arsenal.

As more competition stirs, the quality of NoLo selection is improving, with all signs suggesting consumers are here to stay. Despite being a relatively boutique product – commanding a mere 3.5 percent volume share of the industry – the global NoLo market has soared to an estimated US $10bn.

“Independent brewers are seeing promising growth as is, but NoLo offerings have separated themselves as the clearest growth area in the frothy market. For our indie brewers that have done it tough these last couple of years, it’s opening up revenue streams and changing consumer behaviour,” said Unleashed Software’s Gareth Berry.

Study findings:

- Indie NoLo producers are seeing more than 3x the revenue growth of non-NoLo brewers: Producers with NoLo offerings saw nearly 20% higher growth in YoY sales revenue than those that didn’t, with 28.6 percent year on year growth for NoLo offerers, compared to 9.2 percent for producers without (calculated for financial years from 2018-2022)

- NoLo has been a sober driver of brewery revenue growth: Producers who have added NoLo products saw an average 41.1% growth in revenue in the year after the NoLo products were released.

- Revenue growth has more than doubled for some NoLo customers in the last two years: Some NoLo customers have seen revenue growth north of 100%, underlining the explosion in demand for NoLo products

- In lockdown environments, NoLo is an elixir for revenue life: In 2020 when non-NoLo brewers saw -0.1% revenue decline, those with a NoLo offering saw revenue jump by more than a quarter (25.3%)

No or low alcohol products are typically produced in two distinct ways; through arrested fermentation, where the process is cut short before alcohol is created, or reverse osmosis, where alcohol is removed from the product at the end.

Unleashed's Chief Executive Gareth Berry reckons that even with the significant costs involved with producing a clear-headed beer, they're still typically worth the hassle.

"On the face of it, the costs involved with producing a keg of NoLo and a keg of regular APA would look very similar. It takes more time and money to get a NoLo recipe consumers actually want, and the brewing and labour costs are often higher too. However, once that’s done you’ve got that ongoing advantage of not paying excise – which is only going up. If brewers can get it right, NoLo represents an exciting opportunity for our entire industry," said Berry.

The success of NoLo falls against a backdrop of increasingly expensive pints, due in part to the rising inflation levels, as well as excise taxes. The bubbling costs number among the many reasons why manufacturers will be considering adding a sober option to their brewing arsenal.

As more competition stirs, the quality of NoLo selection is improving, with all signs suggesting consumers are here to stay. Despite being a relatively boutique product – commanding a mere 3.5 percent volume share of the industry – the global NoLo market has soared to an estimated US $10bn.

“Independent brewers are seeing promising growth as is, but NoLo offerings have separated themselves as the clearest growth area in the frothy market. For our indie brewers that have done it tough these last couple of years, it’s opening up revenue streams and changing consumer behaviour,” said Unleashed Software’s Gareth Berry.

No or low alcohol products are typically produced in two distinct ways; through arrested fermentation, where the process is cut short before alcohol is created, or reverse osmosis, where alcohol is removed from the product at the end.

Unleashed's Chief Executive Gareth Berry reckons that even with the significant costs involved with producing a clear-headed beer, they're still typically worth the hassle.

"On the face of it, the costs involved with producing a keg of NoLo and a keg of regular APA would look very similar. It takes more time and money to get a NoLo recipe consumers actually want, and the brewing and labour costs are often higher too. However, once that’s done you’ve got that ongoing advantage of not paying excise – which is only going up. If brewers can get it right, NoLo represents an exciting opportunity for our entire industry," said Berry.

The success of NoLo falls against a backdrop of increasingly expensive pints, due in part to the rising inflation levels, as well as excise taxes. The bubbling costs number among the many reasons why manufacturers will be considering adding a sober option to their brewing arsenal.

As more competition stirs, the quality of NoLo selection is improving, with all signs suggesting consumers are here to stay. Despite being a relatively boutique product – commanding a mere 3.5 percent volume share of the industry – the global NoLo market has soared to an estimated US $10bn.

“Independent brewers are seeing promising growth as is, but NoLo offerings have separated themselves as the clearest growth area in the frothy market. For our indie brewers that have done it tough these last couple of years, it’s opening up revenue streams and changing consumer behaviour,” said Unleashed Software’s Gareth Berry.